There's no single thing called a "credit builder program"; instead, there are a handful of different financial and non-financial programs you can enroll in to boost your credit. Some of them work, some are minimal in their impact, and some are scams.

How do you know which is which? What should you pursue?

Let's dig in!

Credit builder programs generally fall into a few categories.

While they each work a bit differently, they are all designed to help individuals boost their credit score by establishing a pattern of on-time payments to creditors.

To see how these all work, let's talk about them in greater detail.

Let's start with credit-building loans.

You take out a loan for X amount of money at Y% interest with a typical loan. You make payments over time, showing your reliability and improving your credit score. You also pay interest, which can be steep over time. However, it's also a risk; you use the money from the loan to buy something, and you have to come up with the funds to repay it.

When you take out a loan with a credit builder loan, you aren't given the money. Instead, the money is put into a short-term savings or investment account, like a Certificate of Deposit (CD), where it can earn some interest.

Then, for the duration of the loan's terms, you make payments towards the loan. Making regular payments towards a loan builds your credit, and since the loan values are usually small (often under $1,000), the payments are easy to make, and the hit to your credit utilization is low.

So, wait. If you're paying a company to hold money in a savings account in your name, how do you benefit, other than your credit score? Well, when you finish paying off the loan, the loan's value is returned to you. The savings account/CD is cashed out and given to you.

You end up building your credit, and the only costs are:

Because the company controls the money the entire time you're making payments, it's no risk to them, so they're much more willing to issue these loans to people with bad or no credit, unlike a typical financial institution. And, because you aren't given the money until you fully pay off the loan, there's no temptation to splurge and waste the money, then fall off the wagon in paying.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.

A credit builder loan is often a short-term loan, though some servicers offer them up to 10-year terms. Making regular payments on a credit builder loan can potentially increase your credit score between 25 to 75 points.Typically, a debit card is tied directly to your bank account and pulls money immediately in an ACH transaction when you pay for a product or service. Money is transferred immediately, with no need for a line of credit, interest calculations, monthly payments, or any other trappings of a credit card.

Since debit cards require you to have the funds on hand, it's essentially just like cash. The transaction isn't reported to the credit bureaus because it doesn't say anything about your ability to handle credit, just cash on hand.

Unlike credit cards, you can't go into debt with a debit card (unless you overdraft your account, which the financial institution typically disallows). It doesn't count as part of your credit utilization.

A reported debit card is a twist on this concept. It works like a debit card, linking to your bank account and only allowing you to buy things if you have the money on hand. However, it also works like a credit card by putting the transaction on a line of credit to be repaid.

The difference is the repayment terms. With a credit card, your debts are tallied up, and you're issued a monthly bill for part of the overall balance, while any remaining balance accrues interest. With a reported debit card, your transactions are due for repayment within 24 hours, and the money is debited from your account automatically.

This strategy is no different from monitoring your credit card and paying off any outstanding balance every day or week. However, doing so with a credit card requires you to have the discipline to do so and the funds on hand if you make a purchase beyond what you have available in your bank account. With a reported debit card, you can't buy anything you don't have the money on hand to pay for.

In exchange for the tighter limitations on buying with the card, your reported debit card is reported to the credit bureaus. And, since the card requires you to have the money to pay it off before you use it, it's low-risk to the issuer, so they're willing to issue it to individuals with poor credit.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.

These debit cards can boost your score anywhere from 5 points to a whopping 100 points, depending on your initial credit score and how frequently you use the card.Consider all of the bills you have to pay regularly to survive.

Sure, some of these aren't essential – nobody needs a Netflix subscription to survive – but they're usually bills that you regularly pay, on time, every month. Why shouldn't that be reported to the credit bureaus? It's proof that you can pay a regular monthly bill, on time, with no delinquency issues.

Any of these can be reported to the credit bureaus, but it's usually the responsibility of the company issuing you the bills. It's also expensive for those companies, and a company like Netflix or your property manager/landlord doesn't want that added expense for no benefit to them. Thus, those bills are never reported.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.

Unfortunately, you cannot self-report your own bills. Only officially-designated "data furnishers" can report bills. That's where bill reporting services come in.Bill reporting services come in two forms.

1. The first is usually for rent. You give the rent reporting company read-only access to your bank account, so they can scan your bank statements for rent payments and report those payments to the credit bureaus. They can generally report up to the last two years of rent payments immediately, which can be a massive boon of up to 40 points of credit score growth near-immediately.

There may be some restrictions, however. You need to have a valid rental agreement for these services to verify your payments, and they may not be able to confirm if you pay in cash, even if you withdraw the cash regularly. They're verifying a specific transaction, after all.

You can also enroll in ongoing reporting, usually for a minor (under $5) monthly fee.

2. The second form of bill reporting works for other bills, like your utilities or your entertainment.

They work by, essentially, issuing you a heavily-limited credit card. You switch your payment method on those services to the credit card, and the credit card charges you for the bills every month just like if you were paying the bills as you typically would. The only difference is where your money is going and where the money is coming from that Netflix or your utility company sees.

Because it's technically a credit card, it builds your credit by showcasing credit utilization and regular payments reported to the credit bureaus. They also generally don't charge interest because you're guaranteed to pay off your balance every month, or they stop paying your bill for you.

Unlike rent reporters, bill reporting doesn't reach back and report historical payments, so you need to enroll and use the service on an ongoing basis. Thus, your credit growth will build over time but starts small.

If you have low credit or no credit, it can be tough to get started. Many credit issuers will either not give you the time of day or will only offer you programs with extremely steep interest rates or very unfavorable terms.

Credit building programs take advantage of loopholes or structures in payments that:

As such, they can help you if you're in a position to use them.

There are always downsides, though.

You "take out a loan" with a credit-building loan, but you don't get the money until you're done paying it off. So, you're essentially just paying money for nothing except a boost to your credit score. It's an added bill that may not be feasible to support if you're already tight on cash.

Reported debit cards require you to use them properly, though if you already use a debit card, there are no real drawbacks.

Bill reporting also tends to be limited in that it can only report certain kinds of bills, so you have to have those bills first. Rent reporting won't work if you've spent time homeless, pay your rent informally, or don't have an official rental agreement.

These are all more favorable to you than many other forms of building credit. Unlike secured credit cards, you don't have to worry about the risk of going into debt, and you don't need the sizable up-front payment. Unlike becoming an authorized user on someone else's card, you don't have to have a friend willing to risk their credit for you.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.

The truth is, these programs work. How well they work depends on the program you use, your existing credit, and other factors that might be suppressing your credit. Many people will see a jump of anywhere from 20 to 100 points, depending on those various factors.These are some of the best options for improving your credit quickly and effectively. You need to make sure you're financially able to keep up with the payments and pay the small fees associated with using the services. Rent reporting, for example, might charge you $2-5 per month. It's minuscule, but it's still essential.

Please give them a look. There are dozens of companies providing these services today, so you have plenty of choices. Find the ones that work best for you. Whether you're having trouble securing a mortgage or trying to get your first credit card, these credit builder programs can be a huge help to prove to the credit bureaus that you're capable of making on-time payments.

Do you have any questions about any specific credit building program? Are you thinking of trying one of these credit-building programs, or have you used any of them in the past? Please let me know! I'd love to get a conversation started on this subject for the benefit of everybody reading and working to boost their credit score.

The single most significant factor in calculating your credit score is your payment history. Making up 35% of your FICO score, payment history is a value assigned to how well you've been able to repay your debts. Do you make your payments on time? Have you made them on time for months, years, or decades?

An isolated incident can still be devastating. According to FICO's credit damage data:

"…one recent late payment can cause as much as a 180-point drop on a FICO score, depending on your credit history and the severity of the late payment."

Considering that the FICO score goes from 300 to 850 – a 550-point range – a drop of nearly 200 points is enormous. Now, sure, that's the worst-case scenario. A person with a perfect credit score who suddenly drops a payment and misses it for 90+ days will see a huge hit. People with lower starting credit and only a couple of late payments won't see as significant an impact. Even still, though, it has the potential to be very damaging.

No wonder people will take any opportunity to try to alleviate that drop. That's where a goodwill letter comes into play.

What is a goodwill letter? It's a letter that you write to your creditor asking them if they can waive reporting a late payment to the credit bureaus.

If the creditor accepts, they don't inform the credit bureau of the late payment, and your credit score doesn't take a hit.

The idea of a goodwill letter is to appeal to the empathy of the decision-makers who work for your creditor. You appeal to them based on your past payment history, a demonstration of temporary hardship, and a genuine plea to have the mark removed from your credit report. It is, in essence, an apology and a promise not to let it happen again.

The idea of a goodwill letter is to appeal to the empathy of the decision-makers who work for your creditor. You appeal to them based on your past payment history, a demonstration of temporary hardship, and a genuine plea to have the mark removed from your credit report. It is, in essence, an apology and a promise not to let it happen again.A goodwill letter works on several levels.

Goodwill letters don't always work. However, negative marks stay on your credit report for up to seven years, so it's always worth a shot sending the letter and ask if they can remove it. You don't lose anything for trying, after all.

A goodwill letter is helpful in certain circumstances, but it's not always necessary.

First of all, if there's a negative mark on your credit report, your first step is to verify that it's legitimate. Sometimes, messages get mixed up, payments get lost or misattributed, or computer systems mishandle your information. If an issue is reported on your credit report but not a real one, a goodwill letter isn't the correct response. Instead, you should dispute the information with the credit bureaus. You challenge the validity of the issue, and upon investigation, it will be removed if it's inaccurate.

So, for example, in a case of a genuine mistake or identity theft, you can get damage to your credit reversed. However, for legitimate late payments disputing the validity of the issue isn't going to help.

A goodwill letter is also unnecessary if your late payment isn't very late. Generally, companies won't report a late payment to the credit bureaus until it is at least 30 days late. If you've missed your payment deadline by a week but afterward you immediately pay it, you won't see that late payment reported to the credit bureaus. You may get a strike with your creditor. You may have to pay the penalty, lose a bonus or introductory rate, or otherwise deal with a fee according to the rules of the creditor, but you won't see damage to your actual credit score.

A goodwill letter is generally the best option if you have a single late payment that you missed for over 30 days but less than 90 days and when you have since both paid the outstanding bill and resumed regular payments. In other words, it works best for one-time, isolated incidents.

Will a goodwill letter work? After all, creditors are usually large banks, and they have so many millions of customers that they don't necessarily have to care about you. What incentive do they have to keep you around, assuming you're not a business-level or millionaire-level customer?

The truth is, goodwill letters only work some of the time. It varies a lot depending on many factors, including:

Goodwill letters can be effective in cases of technical issues and personal issues. For example, suppose your auto-pay was somehow turned off, and you didn't notice a technical error with the creditor's computers failing to process a payment. In that case, a goodwill letter can potentially eliminate reporting the late fee.

If you don't have your car for transportation, you may lose your job, which would jeopardize your ability to pay your bills, so you accepted the action that was most likely to keep you financially solvent. Similarly, if you had a brief but temporary financial hardship – a significant unexpected expense between paychecks, you can explain it and potentially get a waiver. For example, say you had a flat tire and needed to pay to get a new tire, which pushed your bank balance low enough you couldn't pay your bill until your next paycheck, which forced the bill into late payment status.

Whether or not a goodwill letter works is often up to the whims of chance. There's no formalized process across the industry.

Note: Some creditors will make public statements that they will not accept goodwill letters, usually citing the Fair Credit Reporting Act requiring them to report accurate information. It never hurts to try, and many of these creditors will still accept a goodwill letter. It's always worth a shot; the worst that they can say is no.

Note: Some creditors will make public statements that they will not accept goodwill letters, usually citing the Fair Credit Reporting Act requiring them to report accurate information. It never hurts to try, and many of these creditors will still accept a goodwill letter. It's always worth a shot; the worst that they can say is no.Remember that a goodwill letter is an emotional appeal to the individual capable of making decisions regarding your account. You'll need to keep that in mind as you craft your letter and focus on the hardship that made it impossible to make your payment on time (with the steps you're taking to resolve it).

A goodwill letter needs to be well-written and compelling to have any chance of success. It's an emotional appeal. Thus, there are some things it needs to contain and others it should not.

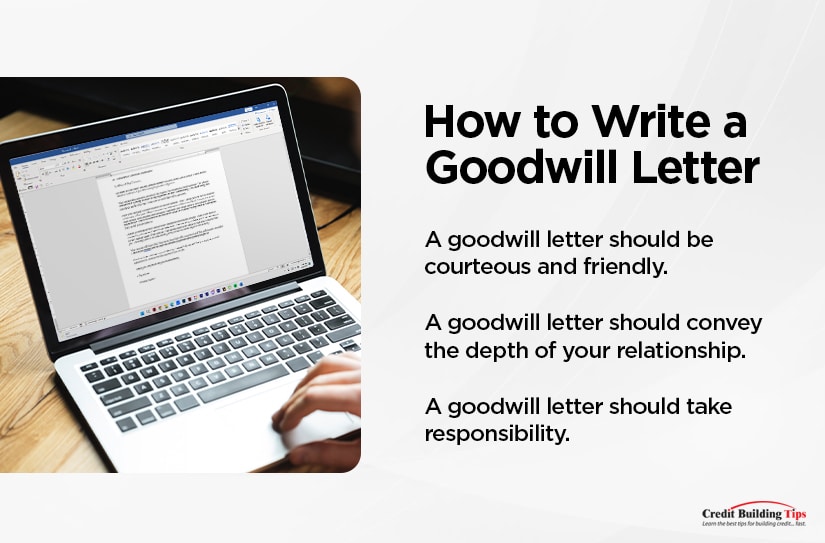

A goodwill letter should be courteous and friendly. The number one thing every goodwill letter needs is a positive attitude. Your credit score is serious business, and you may be feeling desperate or angry. However, you should avoid blaming the people who work for the creditor in question. Even if the issue is on the creditor's end, getting angry about it – specifically when that anger is directed at someone uninvolved with the matter – will only hurt your chances.

A goodwill letter should convey the depth of your relationship. If you've been banking successfully with this creditor for 15 years, say as much. Any deeper, happier, or more successful business-customer relationship will work in your favor. Creditors will often value their long-term customers and may be more willing to cut you some slack, especially when they can quickly look up your past payment history and see that this is a one-time incident.

A goodwill letter should take responsibility. In the end, your late payment is (usually) your fault. It may be unintentional, or it may have been a calculated risk in a time of financial hardship, but it's still a bill you were responsible for paying that you did not pay. Personal responsibility is a big part of a goodwill letter.

Note: if the reason your payment didn't go through is legitimately not your fault – such as when the creditor's computer systems broke or they didn't auto-debit your account as they should have, you may be able to get the issue sorted out with a phone call to support rather than a goodwill letter. After all, when it's genuinely their error, they are responsible for solving it.

Note: if the reason your payment didn't go through is legitimately not your fault – such as when the creditor's computer systems broke or they didn't auto-debit your account as they should have, you may be able to get the issue sorted out with a phone call to support rather than a goodwill letter. After all, when it's genuinely their error, they are responsible for solving it.Shifting the blame away from you when it's your fault looks juvenile and immature and makes your goodwill letter less likely to be accepted.

A goodwill letter should present a compelling argument. Present the facts of your case and why a higher credit score is required of you. For example, you might explain a scenario wherein you had to make the tough decision to let your account lapse after an unexpected medical issue or other expense. Present the length of your relationship with the creditor, your history of on-time payments, and any other supporting evidence. You're making the best of a bad situation and asking forgiveness.

Suppose you need a higher credit score for getting a mortgage or car loan; present that information to the creditors to support your case. After all, if the creditor can help you lower your other bills, you're less likely to experience delinquency again.

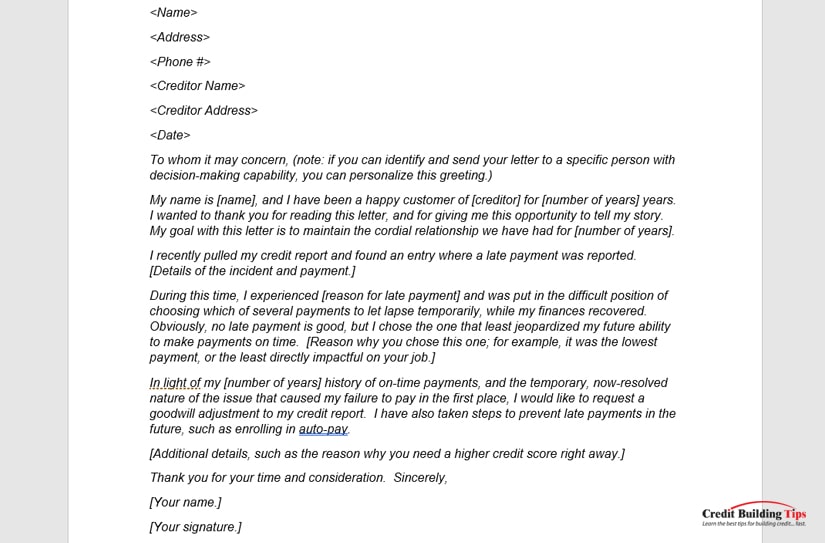

If all of the above seems tricky to compose, you can always use a template. The question is, should you?

Templates are great for people who don't have the writing chops to craft something themselves. However, it's always possible that using a standard template could hurt your chances. Remember, the people who receive these letters often receive dozens or hundreds of them, and when they see the same template repeatedly, they may no longer see it as genuine.

That's why we've created this template. It's a unique template – not copied from other sources online – and since we're a smaller site, it probably hasn't been used very often. If you use it, let us know; we may be able to edit it periodically to keep it fresh. That said, here's a template you can consider using.

Remember, this should be in letter format. You should have your name, return address, and contact information in the upper left.

To whom it may concern, (note: if you can identify and send your letter to a specific person with decision-making capability, you can personalize this greeting.)

I wanted to thank you for reading this letter and giving me this opportunity to tell my story. My name is [name], and I have been a happy customer of [creditor] for [number of years] years. My goal with this letter is to maintain the cordial relationship for [number of years].

I recently pulled my credit report and found an entry where your company reported a late payment. [Details of the incident and payment.]

During this time, I experienced [reason for late payment] and was put in the difficult position of choosing which of several payments to let lapse temporarily while my finances recovered. No late payment is good, but I chose the one that least jeopardized my future ability to make payments on time. [Reason why you chose this one; for example, it was the lowest payment or the least directly impactful on your job.]

In light of my [number of years] history of on-time payments and the temporary, now-resolved nature of the issue that caused my failure to pay in the first place, I would like to request a goodwill adjustment to my credit report. I have also taken steps to prevent late payments in the future, such as enrolling in auto-pay.

[Additional details, such as why you need a higher credit score right away.]

Thank you for your time and consideration. Sincerely,

[Your name.]

[Your signature.]

Have I convinced you about the benefits of submitting a goodwill letter? Do you have any questions for me? Please drop your questions in the comments below, and I'll do my best to point you in the right direction! I'm happy to help, and your questions (and my answers) are bound to help others as well!

Maybe you've just moved into a new apartment or a home, and you're looking to build your rooms with some new furniture. Perhaps you have a new addition to the family coming soon, and you need a crib and a child-size bed. Maybe you're looking at replacing an old hand-me-down couch and want a new one.

You look around, do some shopping, and what you see is shocking. Individual pieces of furniture can cost as much as a used car. Couches can cost upwards of $5,000, and bedroom sets can surpass $3,000 - on sale.

Most Americans are living paycheck to paycheck. How can you hope to swing that much cash for a piece of furniture?

As you might expect, there are options. You could try to take out a loan, but going to the bank and asking for a loan to buy a couch is disheartening. You can put the furniture on credit, but if you need your credit card for emergencies – or your credit limit is lower than the furniture cost – you might not want to do that.

Luckily, many furniture stores today understand this. They use systems like Afterpay, Klarna, or Affirm, to offer financing options. They may also offer in-store financing. You can buy your furniture, get it delivered and set up, and make lower monthly payments until you've paid it off.

Financing anything – whether it's a home, a car, or a couch – involves opening up a line of credit, and that all gets reported on your credit report. That brings us to the crux of the issue; will financing a piece of furniture hurt your credit score, and if so, is it a temporary or long-lasting hit?

If we distill everything down to a simple answer, then the answer is yes. Yes, financing a piece of furniture can hurt your credit score. The damage may be temporary or permanent, depending on various factors, and that's what the rest of this post will discuss.

Any time you open up a new line of credit, you run the risk of hurting your credit score. Most of the time, the drop in points between opening a new line of credit and the credit checks associated with it will be temporary.

Your score will recover, especially as you make regular payments on time, and when you close out the account successfully, your score will potentially even rise.

Your score will recover, especially as you make regular payments on time, and when you close out the account successfully, your score will potentially even rise.What factors should be considered? Do you have alternatives?

Let's dig in.

Financing furniture can be risky in more ways than just your credit score. Your credit score is essential to significant financial decisions and major purchases, but it's not usually impactful for most of your everyday purchases. Meanwhile, your ongoing monthly expenses, debt, income, and ability to pay for living costs are much more impactful. Here are several of the risks inherent in financing furniture.

One of the most significant risks of financing furniture is over-spending. This risk can present itself in two ways.

The first is only looking at monthly payments and not the overall cost of a piece of furniture. You don't notice because all you see is a $99 monthly payment. A good furniture piece might run you $1-2,000, but the price jumps up to nearly double when financed.

The second risk is spending more than you need to pay. What's the difference between a $2,000 couch and a $5,000 couch? Often, the answer is "a brand name" as much as anything else. The cheaper couch might not have a designer name or come from as fancy a store, but it's still a durable piece of furniture. But, when you're looking at monthly fees instead of overall pricing, it's easy to convince yourself you can justify a more significant expense.

Another risk is the dreaded "introductory offer" that stores will use to get you to sign a contract without fully understanding what you're doing. They'll tell you that you'll have 0% interest for many months or years, but the actual duration of the financing goes on much longer. After a certain point, your total loan value starts to increase. If you don't increase monthly payments to match, you could pay $5,000 for a $3,000 couch just because of how the interest compounds.

Generally, financing furniture is an excellent way for a store to hide the real numbers from their customers and make significantly more from you than they should. Always make sure to read and understand the terms of any financing you consider.

Generally, when you finance a piece of furniture, it will be reported on your credit score in one of two ways.

The first is a "consumer finance loan," a subprime loan commonly responsible for low credit scores. Even if your credit is otherwise acceptable, a consumer finance loan – or more than one, if you're financing multiple pieces of furniture – can look very bad to the credit bureaus.

The other is even worse: the revolving account. Revolving accounts count towards your credit utilization while not giving you the benefits of different kinds of utilized credit - this is because of how a revolving account is reported.

A revolving account is reported as a line of credit with, essentially, 100% utilization. If you finance a piece of furniture for $3,000, your credit report sees a new line of credit with a $3,000 limit and $3,000 utilization for 100%. This increase adds to your other lines of credit. If you have one credit card with a $4,000 limit and a $500 balance, your credit score utilization is 12.5%. If you add on the furniture account, you now have a total credit limit of $7,000 and total utilization of $3,500, or 50%.

Utilization is 30% of your total FICO score, and a higher utilization is generally worse. Going from 12.5% to 50% overnight is devastating.

Another factor related to your credit utilization but slightly different is your debt-to-income ratio or DTI. Your DTI is the percentage of your income that goes towards your debts every month. You total up all debts (like mortgage, car loans, personal loans, and, yes, financed furniture) and divide them by your monthly income.

If you make $2,000 per month and have $1,000 per month in ongoing debts, your DTI is 50%.

When you finance furniture, you're adding to your debt burden - this isn't always a bad thing (debt is natural and expected), but a high DTI can be detrimental to your credit score.

When you finance furniture, you're adding to your debt burden - this isn't always a bad thing (debt is natural and expected), but a high DTI can be detrimental to your credit score.The trick is that DTI isn't directly relevant to your FICO score. It's indirectly relevant. Lenders will look at your reported DTI to decide what kinds of loan terms to give you. A high DTI can make it harder to get a car loan or mortgage or will only offer you hire rates when you get one. That further hurts your overall financial situation.

One of the most significant risks of financing furniture is missing payments, paying late, or generally failing to pay on time.

Late payments can be detrimental to your credit score simply because your payment history and reliability are part of your score calculation. If you fall behind on payments, it can be reported to the credit bureaus and negatively impact your credit score.

Late payments can be detrimental to your credit score simply because your payment history and reliability are part of your score calculation. If you fall behind on payments, it can be reported to the credit bureaus and negatively impact your credit score.Moreover, it's easier to slip on paying for something like a piece of furniture than it is something more essential, like medical bills, rent, car payments, or credit card debt. Furniture purchases aren't viewed with the same seriousness as a car loan, even if, legally speaking, the loans are near-identical.

On top of this, even if you financed furniture for 0% interest, there are guaranteed to be fees for late or missed payments. Those penalties can add up on top of the loan's initial principle, making it harder to keep paying off.

Many furniture stores will happily work with you to lower or even temporarily defer your payments if you face financial hardship. However, many people don't think of that option and might not consider it. The vendor would much rather continue to get regular payments than have to deal with collecting on an account or selling the debt to a debt collection agency.

If you miss enough payments on any loan, you go into default. You can also default on a loan for furniture. If anything, that second example is even more common. Paying a credit card or a bank loan is more prominent and usually has higher value and higher importance; if any debt will slip through the cracks, it's financed furniture or other household items.

Defaulting on any loan is devastating to your credit score. Moreover, you may still end up with financial penalties. Often, if a collection agency can't get you to pay, they will get a court order to repossess the item in question, like your couch. Since furniture depreciates significantly, it will be valued lower when they sell it than the remaining value of the loan, and you'll still be responsible for the difference. Further financial strain puts additional stress on your ability to handle payments and can spiral your credit score downwards.

Now, if you read through the above and think, "none of this is relevant to me; I'm not going to default on my loan," that's fine. Financing is acceptable when done correctly, with no late or missed payments.

That's all it is: fine. It's not inherently good for your credit, but neither is it bad.

You will take an initial hit to your credit for opening a new line of credit for the loan, and that hit might be significant due to the nature of furniture financing, as mentioned above. However, as you continue to pay down the loan and show financial responsibility, your credit score will rise - potentially higher than before.

You will take an initial hit to your credit for opening a new line of credit for the loan, and that hit might be significant due to the nature of furniture financing, as mentioned above. However, as you continue to pay down the loan and show financial responsibility, your credit score will rise - potentially higher than before.Your credit score may even have improved when you finish paying off the loan. By paying for financing, you demonstrate that you can be reliable with your payments and that payment history can be beneficial.

Is financing furniture better than putting the cost of the furniture on a credit card, assuming you have a limit high enough to support it? No, not really. A revolving account can be worse than a higher credit card balance, but neither is great, and we're likely talking about a difference of less than 5-10 points. Either way, you're bumping up your credit utilization.

If reading all of the above has scared you away from the idea of financing, don't fret; you have two alternatives.

The first, if you need furniture immediately, is to buy used. Used furniture may not be as glamorous – and it can still be expensive to purchase directly – but it's an excellent way to get furniture for less cost than buying and financing new. Even if it's only a year or so old and relatively undamaged, used furniture is going to be much less expensive than the same piece of furniture brand new. It's like a new car losing value the moment you drive it off the lot.

If you buy used from another individual, it won't even be reported on your credit score. If you buy from a used furniture store, you would only notify the credit bureaus if you purchased it with a credit card or financed it, and even then, the number is much lower, so the hit to your credit is lower.

If you don't need furniture immediately, the other option is to save for it. Calculate your monthly payment for the furniture if you financed it, and then put that amount of money into a savings account each month. Then, when you've racked up enough to purchase the furniture outright, you can afford the purchase and save significant amounts of money on financing fees and interest.

You avoid any fees or penalties associated with financing by saving up for a purchase. You prevent any hit to your credit report. You also have liquid cash available in the case of a catastrophe and the need to spend in an emergency. On top of that, you can even gain some value to your credit score by purchasing with a credit card and immediately paying it off.

Financing, when done correctly, isn't going to demolish your credit score. However, it's still not often a good idea unless you have no other options.

Are you considering financing furniture, and have you considered some of these other options? Will you finance through your bank, a credit union, or directly with the furniture seller? Do you have any questions for me on this topic? Please let me know in the comments section, and I'll do my best to point you in the right direction!

In our modern world, having access to a car is near-essential. Urban sprawl, poor public transportation, inaccessible city design, and other factors all come into play to make cars a requirement for participation in society. Regardless of your feelings on the matter, this is the reality of our modern way of life.

Whether to buy or lease a car is one of the most important decisions you'll make, and it has repercussions beyond just your monthly payments. It can even impact your credit score. The question is, is it good or bad, or both? Can it help you build a score, or can it hurt to lease?

Let's dig in.

Your credit score is a numeric indicator of your financial reliability. It is used in many different situations where large amounts of money or assets are on the line. Much like when you want to find an apartment to rent, your credit score can impact your ability to obtain a vehicle.

Having bad credit can impact your ability to qualify for a car lease, affecting your ability to be eligible for a car loan. Despite the outward similarity – approval for money for a vehicle – credit can impact your ability to qualify differently.

Having bad credit can impact your ability to qualify for a car lease, affecting your ability to be eligible for a car loan. Despite the outward similarity – approval for money for a vehicle – credit can impact your ability to qualify differently.There are two significant differences between leasing and buying that mean your credit score has a different impact.

The first is the source. You're making a deal with a car dealership when leasing a car. If you default, the company leasing you the car is at risk, who has to repossess the vehicle to recoup their losses, and who has to collect payments regularly. When buying a car, you're typically working with a bank to get a loan to pay for the car, at which point the dealership has no further hand in it, and the deal is between you and your bank.

Banks are more flexible with credit than dealers because they tend to have better arrays of safety nets in place and more options for handling financial issues. Dealerships are much smaller entities.

The second difference is the collateral. When you apply for a car loan and use that loan to buy the car, the car becomes collateral. You're paying towards the loan, which the bank technically owns until you pay it off and they send you the paperwork. With a lease, the dealership owns the vehicle, and you're just granted temporary use of it.

All of this means that leases tend to have higher standards for credit scores than loans. Most auto dealerships will only lease a vehicle to someone with a credit score of 620 or above, and many prefer a score of over 700.

An exception is the agencies that allow for lease transfers. People who want to get out of a lease can "sell" the lease to you; you take on the lease for the remainder of its duration, picking up responsibility. This option can be a good choice when credit is exceptionally poor or non-existent.

Both leases and loans have variable terms, and the lower your credit score, the worse the conditions will be for you, primarily in the form of an interest rate for loans and monthly payments for leases. A bad credit score means you're less reliable financially, so a dealership will want to get the most out of you that they can if you default.

You may be able to qualify for a loan to buy, but the terms may not be in your favor. In practice, what this means is that if you have bad credit, you likely won't even be offered the option to lease. Even still, it's better than nothing.

However, all of this is about your credit score before you buy or lease. The question is, though, what happens to your credit score after you sign the paperwork?

Your credit score is a single number calculated based on several factors. The five elements, and their weight in the total calculation, are:

The single most significant factor influencing your credit score is establishing a history of paying off your debts.

The single most significant factor influencing your credit score is establishing a history of paying off your debts.It doesn't matter if it's a credit card you pay off fully every month, a loan you pay the minimum towards each month, or a lease you pay regularly; the act of making regular payments, on time, with no late payments or defaults, is the critical part.

When you sign a lease for a car, you're signing up to make regular payments. Making those regular payments can benefit your credit score – if the dealership reports leases to the credit reporting bureaus. Most dealerships will make those reports, but occasionally one may not. Your credit score is only based on what is reported, so if your payments aren't being reported, they won't do you any good.

The general exception is rent-to-own businesses, similar to but distinct from leases. Rent-to-own agencies often don't report to credit bureaus because they're self-interested and specifically target people with poor credit. Those credit scores don't improve by not reporting, so those customers are forced to use their limited options. Cynical, predatory, but legal.

If you can get one, a lease for a vehicle can help build your credit score by establishing a reported history of regular payments. It can also add to your credit mix and be part of new credit, so it has more impact than you might expect.

Buying a car is similar to any other loan. Qualifying for a loan has a relatively low bar in terms of credit score, but the better your credit score, the better the loan terms.

The dealership doesn't necessarily care about your credit score unless they work with their financing process. If you come with a cheque in hand, money is money, and you'll get your car. You have to deal with a financial institution to get the loan, but once you have it, the vehicle is yours.

A car loan is a loan and, as such, impacts your credit. Opening a new loan, making regular payments on the vehicle, and maintaining a reasonable debt-to-income ratio benefit your credit score.

A car loan is a loan and, as such, impacts your credit. Opening a new loan, making regular payments on the vehicle, and maintaining a reasonable debt-to-income ratio benefit your credit score.The only way buying a car will hurt your credit is:

Opening a new loan account can temporarily hurt your credit, but your credit will grow as long as you maintain making payments on time.

When a lease ends, you give the car back to the dealership, and the relationship ends. At least, that's the way it works on paper.

In reality, most dealerships will offer you three options.

When a lease ends, and a new one begins, it may not even be reported as a new lease and will no further impact your credit score. If you choose to buy the car or walk away, the cancellation of the lease may hurt your credit score a small amount, temporarily.

Your credit score can take a minor hit because you're closing a line of credit – even if it was a financial relationship you were successfully paying off – removes one line from your credit mix and number of accounts.

Your credit score can take a minor hit because you're closing a line of credit – even if it was a financial relationship you were successfully paying off – removes one line from your credit mix and number of accounts.However, this credit drop is temporary; in most cases, the credit bureaus are smart enough to recognize that closing the account is beneficial, and your score will return to where it was or higher. This phenomenon is, after all, why your credit mix and number of accounts are such small percentages of your overall score.

The one possible way a lease ending could hurt your credit is if you had additional closing fees, like wear and tear charges, and you don't pay those right away. In that case, it becomes like any other debt you default on and hurts your score.

Like ending a lease, ending a loan closes a credit account and can temporarily cause your credit score to go down. And, much like a lease, when the bureaus recognize that it's a beneficial action, your score will return to its previous heights.

Closing a loan can be more impactful if you have few or no other lines of credit and aren't making any other regular payments that the dealerships would report to the credit bureaus. However, even still, your credit score is likely to be higher than before opening the loan, mainly if you had bad credit and made your payments on time the whole way through.

Whether or not a lease or a loan is better depends on a few factors.

The first is if you have bad credit. With bad credit, anything that improves it can have a significant impact. More importantly, you want short-term solutions rather than long-term solutions because a completed contract is valuable to your credit score.

A car loan usually starts at two years and may stretch as far as seven. That means it can be as much as seven years before you get a completed contract on your record. Of course, regular payments during that time are beneficial, too.

On the other hand, leases are often 1-4 years. If you opt for shorter contracts, you can have more closed contracts and thus a better credit score.

In both cases, however, the history of making regular monthly payments is much more impactful and roughly equivalent between methods.

The other factor is the value of the debt you take on.

You're taking on debt for the car's total value with a car loan. Taking a $30,000 loan for a vehicle means taking on $30,000 in debt - a significant hit to your debt-to-income ratio.

With a lease, the total amount of the debt is only reported when the lease ends and is only the amount you paid. A $30,000 car, after a three-year lease, might only be worth $20,000; your lease burden will be reported to be the $10,000 paid towards it in that time. Your debt-to-income ratio looks better, so leasing has a better impact.

From a pure credit standpoint, leasing may be the better option. However, there are numerous caveats to this.

Then there are the other considerations. With a lease, you are often restricted on the number of miles you can drive in a month. You may not have steep maintenance bills, as the dealership may cover maintenance, unlike with a vehicle you've purchased.

However, terms can vary, so make sure you know what you're getting into.

In the end, the choice may not be yours to make.

Are you thinking of leasing or purchasing a vehicle, or do you already lease a vehicle? Do you have any questions for us about your options? Please share with us in the comments below! It will help other users out, and we would be happy to give you advice on your current situation.

Housing is a basic human need, but there are many roadblocks in our society that get in the way of having a place to call home. One such roadblock for many is a credit score.

When you apply to rent an apartment, a house, a condo, or any other form of shelter, the landlord will do their due diligence to control the property. This process includes several aspects of a background check to minimize the chances of renting to someone who cannot pay, has a history of property destruction, or is an otherwise high risk to the property itself.

One small part of this due diligence is a credit check and credit report analysis. Landlords are (one of several) entities that routinely pull credit reports to analyze their potential renters for suitability.

A landlord is likely to look for your credit score and an overall impression of your credit report.

A landlord is likely to look for your credit score and an overall impression of your credit report.If you're having trouble applying for an apartment or renting a house, read on.

Your credit score is a semi-objective measurement of your financial presence and history. A long and successful history of making payments on time, utilizing credit appropriately, and maintaining diverse assets will help build a credit score. Conversely, a short credit history, a credit history fraught with late payments, or a credit report with adverse events like bankruptcy can drop a credit score.

Credit scores are always a three-digit number ranging from 300 to 850. You can raise this score in various ways, some faster than others.

While there is no objective number that landlords look for, specific credit ranges have certain associations.

A generally-accepted scale typically looks like this:

The question is, what is the minimum necessary to rent an apartment? Can you rent an apartment with a poor score, a fair score, or a good score?

In general, many landlords look for a minimum score of 650 to rent their properties.

In general, many landlords look for a minimum score of 650 to rent their properties.650 falls into the higher end of Fair and is relatively easy to achieve. However, it's not a hard-and-fast rule. Landlords look at more than just the credit score number. Additionally, the competition in the housing market can raise or lower the score necessary to rent in any given area.

Typically, rural areas, areas with lower general income levels, lower property values, and less competitive markets will have an even lower credit score requirement. Some landlords in these areas may not even check credit scores, though this is typically rare.

Conversely, higher value, upscale, and highly competitive markets will have higher credit score requirements. For example, many landlords in New York City – a highly competitive and expensive environment – will look for 680 or 700 as a minimum.

"According to a 2017 survey report from RentCafe, the average credit score of approved applicants was 650, while the average credit score of rejected applicants was 538. The numbers are a little higher for high-end buildings: 683 for accepted applicants and 553 for rejected applicants. The location has an even bigger impact on the average credit score needed for approval. The cities with the highest credit scores were Boston (737), San Francisco (724), Seattle (711), Minneapolis (711), Oakland (707), Philadelphia (702), and Los Angeles (691)." - Bungalow.

Again, this all varies from landlord to landlord and depends on the property's location. Individual landlords may be more flexible than property management companies, as well.

While the credit score is a simple, bite-sized way to analyze an individual's level of financial solvency, it's not the whole story. This shortcoming is why landlords and property managers will typically pull a full credit report rather than rely solely on your credit score.

The full credit report will offer more detail than a credit score alone and can show a landlord more helpful information - this allows them to make a better judgment of their rental candidates.

What might a landlord look for in a credit report? Like the score level required to rent, this can vary from landlord to landlord. In general, they may look for:

A landlord's #1 concern with their tenants is consistency in rental payments. If the landlord isn't getting paid, they're losing money on the maintenance, upkeep, property taxes, and other expenses of keeping up on a property.

Thus, the landlord's most significant factor is the presence and frequency of any late payments reported to a credit agency.

Thus, the landlord's most significant factor is the presence and frequency of any late payments reported to a credit agency.Be aware, however, that late payments are not guaranteed to affect your credit score or even show up on your credit history. Typically, an overdue payment will only show up on your credit report if it has been more than 30 days since the due date of the payment.

If you're living paycheck to paycheck and are late on a payment by 1-2 days, or even by a week, the late payment is still unlikely to show up on your credit report.

In some cases, you may have even more leeway. Some banks, lenders, and financial agencies will not report a late payment until it has reached 60 days unpaid.

The idea is not to punish people who forget a bill or whose mail gets lost, or who lose a job and are temporarily out of income. Minor mistakes should not, and are not, held against you in that way.

This example is also why it can be a good idea to pursue something like an economic hardship deferment or another kind of deferment or payment plan on a past-due loan; because you undertake such a deferment or payment plan with the permission of the financial institution, they generally will not report it as an adverse event on your credit report.

When a debt is past due for long enough, a financial institution no longer wants to pursue collecting the money. Some may forgive the debt, but many sell the debt to a collections agency. The collections agency pays the institution typically pennies on the dollar and then attempts to collect the total amount (or a lesser amount) from you.

This transfer of debt to a collections agency is typically reported on a credit report. A landlord looking up your credit report when you try to rent an apartment will see any accounts in collections, likely along with what collection agency is pursuing it, the value of the debt, and other details.

Debt collectors have an extensive list of laws and regulations governing their behavior. Regardless of your feelings on the ethics of debt collection, the fact remains that collection agencies exist and will be visible on a credit report.

When you or another entity requests your credit information, the request can be classified as a "hard inquiry" or a "soft inquiry." A soft inquiry is not reported on the credit report and is not factored into your credit score - a hard inquiry is.

Hard inquiries typically include credit card companies and lenders pulling your complete credit report. Soft inquiries include checking your report using your legally-mandated free annual report, when a lender pre-qualifies you for a loan offer, and many other credit pulls.

When a landlord checks your credit report, their check may be classified as a hard inquiry or a soft inquiry, depending on the method they use to pull the information.

Having too many recent hard inquiries can lower your credit score. The presence of hard inquiries can account for up to 10% of your credit score.

Having too many recent hard inquiries can lower your credit score. The presence of hard inquiries can account for up to 10% of your credit score.Why would a landlord check if you have other hard inquiries? It gives them an indication of whether you've been applying for other lines of credit, other apartments, or other loans that could affect your ability to pay rent. This factor can be significant if you have many hard inquiries and no new open lines of credit; this indicates you may have been repeatedly denied. The landlord might look for more information as to why this has happened.

There are provisions here.

"According to FICO, its scoring model allows for "rate-shopping" for consumers applying for a loan or, in this case, apartment-hunting for people seeking a place to live. FICO ignores inquiries made within 30 days of your apartment application. So, as long as your apartment hunt doesn't drag on for too long, your score won't be hurt by multiple credit inquiries." - Bankrate.

Essentially, multiple hard inquiries of the same type will be lumped together. If you apply to multiple landlords or mortgage lenders to find the best terms, you may have numerous hard inquiries, but they will only count as one event for your report and score calculation.

Declaring bankruptcy is a complex process with many factors. Bankruptcy can wipe out debts you cannot pay, though some debts cannot be removed through the bankruptcy process. However, it can be devastating to your credit report. It is, essentially, a huge sign that says you were unable to meet your debt obligations.

Of course, there are many reasons why your debt burden could rise up above and beyond your means, including a sudden loss of a job, medical issues, and related strains. Context can be necessary, and while bankruptcy can be devastating, it may not necessarily be a deal-breaker for all landlords.

Another potential red flag for landlords is a high debt-to-income ratio.

Even if you can sustain your debt payments with your income and lifestyle, a high debt-to-income ratio puts you at greater risk of financial disaster if you lose a job or another tragedy occurs.

This can be the worst red flag on a credit report in many ways.

This can be the worst red flag on a credit report in many ways.However, it all comes down to an individual landlord's judgment as to what is an essential factor in their consideration.

Even if you have a poor credit score, you still need somewhere to live. Typically, you have options. While some landlords will deny you the ability to rent from them, others may be more forgiving.

Another option you could consider is apartments that offer no credit checks. These are fine as a last resort, but you risk worse terms and a worse living situation. Be cautious when pursuing this option if you have any viable alternatives.

While landlords generally tend to look for at least 650 in the credit score of their tenant applicants, the score alone does not tell the whole story. If you have a lower score, you may still be able to argue your case and prove your financial solvency. Good luck!

Is your credit score affecting your opportunity to apply for an apartment or purchase a house? Which credit score factors caused you to be denied by your application? Do you have any questions for me? Please share with us in the comments below, and I'll get back to you with an answer!

Wealth disparity is immense in America. While many of the world's wealthiest people live here, the average American is highly likely to either be in debt or be one bad day away from it.

Of course, not all debt is created equal. Some debt is expected, normal, or even good, and many Americans are in a position where, despite being in debt on paper, their wealth and income make it easy to wipe out that debt if they choose. Some debt is acceptable or even expected: a mortgage is a huge debt.

Still, according to reports, as much as 25% of Americans are actively managing their debt, and as many as 61% live paycheck to paycheck, one bad event away from debt.

Still, according to reports, as much as 25% of Americans are actively managing their debt, and as many as 61% live paycheck to paycheck, one bad event away from debt.What are the most common causes of debt? We've pinned down 25 of the most common reasons Americans (and people worldwide) fall into debt.

Few people have the $20,000 to $80,000 it takes to purchase a new or lightly-used vehicle when they need it. Yet, most people in America are engineered to require a car to get around. It's a necessary expense for most of us, and most of us have to go into debt to get it. Worse, the lower your credit, the less favorable your loan terms.

With unfavorable loan terms, the debt can worsen over time with interest and penalties, and more challenging to get rid of your monthly payment.

The average American spends as much as 18 days on the road each year. The NHTSA estimates around 5-6 million auto accidents every year, which equates to around one accident every six seconds. Sure, some collisions are little more than some scraped paint, but others are devastating or fatal. Any accident you walk away from is better than one you don't, but the auto repair bills (and medical bills) can be an instant, near-insurmountable debt.

Cars can also be expensive to maintain. Oil changes, new tires, wiper blades, spark plugs, filters, brakes, car washes - these expenses can add up, especially on foreign vehicles or cars with hard-to-find parts. If you suddenly discover that your tires are bald and you rely on your vehicle for work, you may have to put it on your credit card and pay that off over time while focusing on more important expenses.

Everyone needs a place to live. While rental rates are higher now than they have been since 1965, many Americans still buy a house instead of renting an apartment. Making a real estate purchase is a massive debt in the form of a mortgage. It's not bad debt, necessarily, but it is debt nevertheless.

Avoid living above your means, and move into a house with a reasonable mortgage payment. If your mortgage payment gets too challenging to afford, you may consider renting out a room or selling it to purchase a house with a more affordable mortgage payment.

Owning a home is often a giant money sink, and we're not just talking about the mortgage costs, property taxes, homeowners insurance, and other expenses. What happens if a water heater breaks? A furnace? A water leak destroying a wall? Or even just wanting to remodel a room?

These are significant financial investments, and many people go into debt to fix problems when they crop up. Most new homeowners are tempted to buy new furniture and load up their credit cards, but this can be a costly mistake. We can't foresee the unforeseeable, but setting aside an emergency account for home repairs can help ease this burden and reduce your debt.

What might have been a sustainable living situation five or ten years ago may no longer be feasible, but the cost of moving is even worse.

The cost of living has been steadily rising, while wages have stagnated. Thus, credit is used to stay afloat, and debt begins to mount.

The American medical system is among the most expensive anywhere globally while, in some cases, providing some of the least efficient or effective care.

In many cases, it's cheaper to fly to another country, receive medical care, spend time on vacation, and return than it is to receive domestic care. It's no wonder that over half of all Americans carry medical debt.

"Go to college to get a good job" was a common refrain over the decades. In the past, it was even true. Today, higher education is often dramatically more expensive and less valuable than at any point in history.

There are outliers, but in many cases, the cost of receiving a degree is higher than the benefit it brings to wages, leading to a student debt crisis of unprecedented proportions.

Marriage is a significant expense, as many people have a "dream wedding" they want to host, regardless of the cost. Even without such an expense, getting married typically means sharing financial responsibilities, which can mean taking on a spouse's debt.

Many couples take on debt during this time, and it's essential to keep an eye on it to keep it from getting out of hand. Honeymoons can get expensive, and of course, you can't forget the cost of a ring or a wedding gift.

Many people underestimate just how expensive it is to raise a child. The estimated cost of raising a child from birth to 18 is estimated to be over $270,000, and for many modern families, the financial burden doesn't end at 18.

Even the hospital visit to give birth can cost tens of thousands of dollars. Unexpected expenses can end up on the credit card, and credit card debt can quickly grow out of control.

The separation of a couple brings with it any number of financial burdens. A contentious divorce brings in legal fees and more.

Even an amicable divorce can lead to anything from child support to a dramatic loss of income to a loss of assets.

Underemployment isn't as widely discussed as unemployment, but it's perhaps worse. Underemployment is a case where an individual is forced to work a job they are overqualified to handle because they can't find another option.

The stereotype of a college graduate with a Master's degree working as a barista is an easy example. Underemployment is closely related to stagnated wages and debt in many ways.

A loss of employment, often sudden, can be devastating. As mentioned above, well over half of all Americans live paycheck to paycheck. When those paychecks cease, debt looms immediately.

Even in the best-case scenario, finding a new job can take weeks, and debt can rack up.

Millions of Americans dream of opening and owning their own business. Indeed, being a successful business owner is one way many people can pull themselves out of debt. However, the risk is high. Statistics indicate that over 50% of all new businesses fail before five years.

Often, people invest their funds to keep the company afloat longer than it should survive and go into debt to do it. This example is prevalent, and businesses can be costly to maintain during slow periods.

You may note that most of the causes of debt on this list are outside influences or circumstances beyond your control. One of the few that could be considered a "personal failing" is living outside of your means.

Many people have enough income to live comfortably but choose to live in comparative luxury and pay the price. Even then, societal pressures could be equally to blame.

Everywhere you look, especially in times of financial stress, there are stories of people who make a good stock pick or invest in the right cryptocurrency at the right time and cash out millions. While this is no more likely than winning the lottery, it tricks many people into thinking they can time the market or make a good investment and then get caught up in a scam or over-invest and lose their money.

Tales from WallStreetBets can show you that there are hundreds or thousands of people losing their life savings or going hundreds of thousands into debt for every million-dollar winner.

Payday loans seem like a good concept at first - a company that can give you an advance on your paycheck so you can pay your bills on time. Then you read the fine print and notice that they're charging 15-30% interest rates and other dramatically unfavorable terms, and you can see just how predatory these lenders are.

Needing an advance on your paycheck doesn't put you ahead; it borrows from your future ability to pay off your bills and other debts, with interest rates that only worsen your situation.

How often do you receive a credit card offer in the mail promoting a 0% APR for the first however many months? While these can be tempting, they still facilitate you going into debt on credit.

Moreover, your obligation skyrockets when that introductory rate disappears and the actual interest rate kicks in.

A common technique among car salespeople and, increasingly, websites selling products with services like Afterpay is to point out a low monthly payment. They obfuscate the interest rates and trick you into not recognizing that you'll be paying 10%, 20%, or even more of the item's value above its initial cost.

In extreme cases, you can even find instances of monthly payments being low enough on a high enough initial principal that years of repayment may never touch the initial loan.

An unfortunate reality of living paycheck to paycheck is the need to put unexpected expenses – and then eventually everyday expenses – on credit. It's not inherently wrong to use a credit card!

Utilizing your credit is good to build your credit score. However, you need to pay it off every month, not carry a balance to gain value from it. When you carry a balance over, interest applies, and debt grows.

Sometimes, the debt grows because you don't manage your money correctly. Virtually everyone could use a greater awareness of finances and budgeting than they have.

Whether cutting back on avocado toast and lattes or consolidating debt and refinancing a mortgage, you may be spending more money than you need to.

While gambling is unfortunately quite predatory, many people also suffer from gambling addiction. The lingering promise of a payout around the corner, combined with an addictive personality, can lead to going into debt for just one more play, one more hand, one more pull.

It's a big enough problem that there are official, national assistance initiatives for gambling addiction.

Digital games, online services, and mobile apps all look to make money, and many use microtransactions. They might be free to use, but you can pay -- $5 here, $10 there – to get a slight advantage. It's effortless for an individual to hit that button a few times and suddenly realize they can't reasonably afford their groceries for the month or another bill.

And, since these are relatively new technologies, there isn't much regulation to reduce over-spending or target compulsive spenders.

Whenever a recession or financial crisis rears its head, people go into debt. It's called being underwater, leading to innumerable financial disasters over the decades. Usually, this is related to real estate; if an economic downturn reduces the value of your house, you may end up owing more on it than it's worth.

Moreover, economic recessions typically lead to layoffs, lower wages, and higher prices on necessities. It's even worse when a bubble pops.

Ostensibly, if your identity is stolen and your bank account cleaned out, that money is insured. However, that's not always easy to leverage if bills overdraft an account or cascading repercussions lead to further problems. Even if you get it all sorted out, the stress and time consumption necessary to handle it can lead to other debts.

And, of course, physical crime – such as home invasion, a stolen car, a mugging – can all be financially devastating in their own rights.

It's expensive to be poor. If you can't afford a $500 item, but you can afford a $100 version, you'll go for the $100 version. But, if the $500 item lasts 10x as long, you're spending twice as much during the same period. Is it worth going into debt for the more expensive item? Potentially.

This effect can be seen everywhere. Cheaper food is often less healthy and leads to health issues, illness-related loss of income, and medical bills. Public transit is more affordable than owning a car but takes more time. Over and over, the things you must do when you have relatively little money available will cost more over time than the more immediately expensive alternatives.

Debt isn't always bad, and debt is rarely a personal failure, but it's widespread and affects virtually all Americans in some way or another. How you handle your debt will be a big part of your eventual success or failure with financial security over time.

Are you currently struggling with debt? Do any of these items on this list resonate with you, or did any of these help you by avoiding potentially costly monthly payments? Please share in the comments section below this post! We would love to hear your thoughts.

Credit scores are a fact of life we all have to confront sooner or later. They've attached to us our whole lives, and they rise and fall according to our decisions, often before we even understand what credit is and what affects it.

Moreover, credit scores are inscrutable. The credit tracking agencies keep the specifics of their algorithms a secret. Many people don't even know that Equifax, Experian, and TransUnion are not the exclusive authorities on credit. There are dozens of credit reporting agencies. All of them track and weight aspects of credit differently, so your score across them all will be different.

Yet, despite all of this mystery, credit scores are a critical deciding factor for everything from your ability to buy a car to your chances of getting a mortgage. Having a lower score can tangibly harm your life and lifestyle, and you may never quite know why or even realize it's happening.

As if this wasn't enough, the internet – and casual advice from friends and family – is full of misinformation. For example, maybe you've heard this one:

"Carry a balance on your credit cards, and never pay them off completely; making regular payments helps your score!"

Did you know that this is entirely false?

We're not sure where the myth got started. Maybe it's a misinterpretation of the advice not to close a line of credit, or perhaps it's a myth put forth by banks who pull in the interest on your balance. Either way, it's not true, and it's financially better for you to pay off any outstanding loans or balances as quickly as possible (in general).

Our goal with this site is to provide accessible, easy to internalize knowledge to help you build a higher credit score and improve your quality of life. So, let's start with five tangible actions you can take to improve your credit score quickly.

Your credit score is, in part, a measurement of how reliable you are at paying off the money you borrow. This score applies whether you're getting a massive 30-year mortgage or buying $50 worth of groceries on your credit card. You borrow money, you pay that money back, regularly and on time.

One aspect of credit that hugely factors into your score is utilization. Credit utilization is the amount of your total credit that you use. Utilization also accounts for as much as a third of your credit score, so keeping your utilization low can be a considerable boost.

Your target number is around 30% or lower. So, let's talk about how you get there.

The first thing you need to do is tally up all of your lines of credit and their credit limits. Let's say you have three credit cards:

For now, don't worry about your balances. Just add up the total of all three credit limits. In our example, this is $12,000.

Next, figure out what 30% of your total limit is. 30% of $12,000 is $3,600.

Your goal should be to keep your total running balance across all of your cards at under $3,600. If your total balance across your three credit cards is higher than that, pay off enough to get it under. Keep it low by avoiding borrowing too much whenever possible.

Your goal should be to keep your total running balance across all of your cards at under $3,600. If your total balance across your three credit cards is higher than that, pay off enough to get it under. Keep it low by avoiding borrowing too much whenever possible.Getting and keeping your utilization under 30% is a sure-fire way to boost your score.

Now, we understand that "pay off your debts" isn't exactly helpful advice for many people. Millions of Americans live paycheck to paycheck and don't have the luxury of quickly paying down debt.

Luckily, you can approach the problem from the other side as well. Consider asking your financial institutions for a higher credit limit. If your account is in good standing – that is, no late payments – they may be more than happy to raise your limits. Increasing limits will lower your percentage utilized and can be helpful to your score – as long as you don't rack up even more debt.

Most of the time, asking for a higher credit limit is as simple as calling your credit card or bank and talking to customer service. As long as your account is in good standing – even if you're already carrying a balance – many institutions will be more than happy to increase your limit for you.

This credit increase isn't always purely out of magnanimous interest in your well-being, of course. Banks want you to have a higher limit when you've proven you can pay it off because then you'll be more likely to carry a higher balance and thus rack up even more interest for them to earn off of your spending.

That's why the key here is to ask for a higher limit, but treat your spending as if you didn't have that higher limit. That way, you keep your utilization low and carry as small a balance as possible. This strategy is great because it can boost your score, but it also helps you by keeping your monthly payments small and your interest low.

Note: Some lines of credit will pull a hard check on your credit score when requesting an increase, and others may only request a soft check or won't check your credit at all. It's advised that you ask them for this information before they pull a report.

Note: Some lines of credit will pull a hard check on your credit score when requesting an increase, and others may only request a soft check or won't check your credit at all. It's advised that you ask them for this information before they pull a report.The closer you can get to paying off your debts, the better off you'll be.

Another factor that goes into your credit score is the overall age of your credit history. The older your credit history, the more experience you have with managing your money appropriately, so the better off you'll be.

The trick here is that you have to keep old accounts active. You can't open a credit card and never use it.

Generally, our advice is to set up auto-pay on a bill or two and then forget about it. Even something as simple as a Netflix subscription can be enough to keep your line of credit active with relatively little risk of ever boosting utilization too high or otherwise breaking the pattern.

Now, you don't need to carry a balance to keep a line of credit active. You need to use it. Maintaining a balance only gives banks or financial institutions more money through interest payments and doesn't help you. Use the line of credit, but pay it off as much as possible.

Banks are not infallible. They can make errors. Payments – especially payments by check or mail – can slip through the cracks. Reports can get mixed up. Someone swapping digits on a social security number when they file for a loan can throw an issue on your information when it has nothing to do with you. Identity theft can wreak havoc.

Federal law requires that each of the three main credit reporting bureaus – Equifax, Experian, and TransUnion – provide a full credit report to everyone upon request, for free, once a year. During Covid-19, the credit reporting agencies are offering weekly reports for free. Take advantage of them if you want to keep an active eye on your credit report! You can request your information from Annual Credit Report.

Important: You do not need to pay for your credit report if it's the first one you've requested in the year.

Important: You do not need to pay for your credit report if it's the first one you've requested in the year.Once a year, at minimum, you want to request your credit report and look for errors.

What kind of errors might you find?

Essentially, you can dispute anything inaccurate, fraudulent, or false. How do you do it?

Start by creating a list of all of the errors you find, so you can keep track of what you challenge, when, and when it's removed. You want to maintain proof in case any of it reappears.