Sometimes, building your credit seems like an impossible task. Does this sound familiar?

How do you get a loan to pay off to build your credit if you need good credit to get a loan in the first place?

Luckily, many credit builder loans are structured in such a way that they're attainable if you have bad credit or even no credit at all.

Luckily, many credit builder loans are structured in such a way that they're attainable if you have bad credit or even no credit at all.To understand why, you have to know how they work.

So, let's dig in and discuss how they work and how to get them.

Credit builder loans are akin to normal loans but with a twist.

When you take out a normal loan, you are given money and expected to pay it back over time. The most common uses of loans like this are to pay for purchases much larger than you can normally afford, like a car or a house.

Banks take on a lot of risk for these loans. If you end up not paying back the loan, the bank is the one losing the money. That's why they often have liens or other collateral on record, so if you stop paying your mortgage, you lose the house. Your credit score exists as a way to measure how effectively you control and pay off your debt.

Credit builder loans operate differently. When you take out a credit builder loan, you don't get the money. Instead, the money is put into a bank-controlled account, often a savings account or a Certificate of Deposit (CD) with some small interest rate attached.

Credit builder loans operate differently. When you take out a credit builder loan, you don't get the money. Instead, the money is put into a bank-controlled account, often a savings account or a Certificate of Deposit (CD) with some small interest rate attached.To use a very simple example, say you take out a $1,200, one-year credit builder loan at zero percent interest. That $1,200 is put into a savings account, and you are asked to pay $100 per month to pay off the loan. Each month, you make a $100 payment; by the end of the year, you're down $1,200. When you finish paying off the loan, the savings account is cashed out and given to you; you get your $1,200 back.

Make sense?

There are a handful of different factors that adjust how this situation works, but that's the core idea. Build on it with:

A credit building loan is, essentially, a secured loan. Since the money isn't given to you until you've paid it back, you're the one who takes on the risk, not the bank. If you stop paying, well, the money is still there in a bank-owned account, and they can liquidate it for themselves.

Different credit building loans have different terms and restrictions that may adjust how much they can keep versus how much they give back, if anything, and what they do with interest, fees, and other details. Always make sure to read the fine print on any loan you consider taking out.

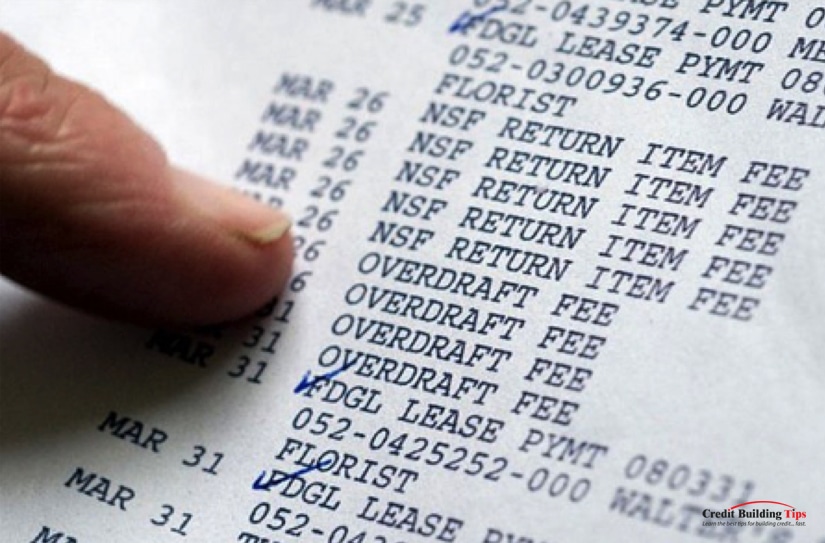

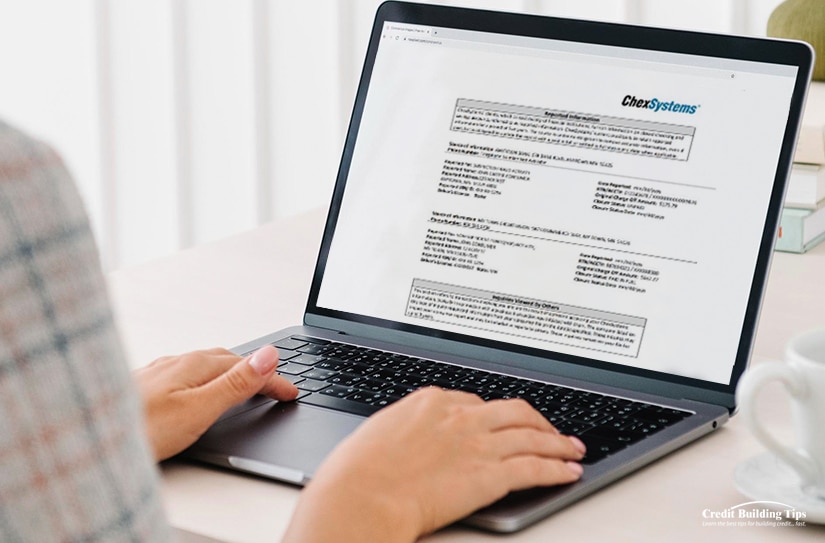

One thing to note is that you can still be denied for a credit builder loan, even when bad credit isn't a problem. Most of these loan providers will still check the ChexSystems report, and if you've had a lot of bounced checks in the past, it can lead to a denial of loan.

One thing to note is that you can still be denied for a credit builder loan, even when bad credit isn't a problem. Most of these loan providers will still check the ChexSystems report, and if you've had a lot of bounced checks in the past, it can lead to a denial of loan.Credit building loans are not standard loans and are not generally offered by most major banks. Instead, you usually have to turn to other organizations to get them.

There are generally three types of institutions offering credit builder loans.

There are dozens of organizations that offer credit builder loans with no credit check. They can do this because, as mentioned above, the credit builder loan is not a risk to the bank. Since you assume the risk of the loan, it doesn't matter what your credit is; the bank can "lend" to you anyway.

Examples of credit building loan servicers include the following. Note, however, that we make no judgment as to the quality of these banks, credit unions, and online lenders; we simply mention that they exist.

This is just a representative sample of financial institutions offering credit builder loans. Their terms, qualifications, and requirements may vary.

Credit builder loans put the risk on you, so you need to make sure any loan you take out is one you can afford to pay back. Luckily, most credit builder loans have relatively low balances and good terms because it defeats the purpose if people can't handle paying them off.

Still, you need to take a close look at your financial situation and determine how much you can afford to reliably pay every month. Taking on a loan that asks you to pay more than that amount is a significant risk because a credit builder loan only helps you if you maintain successful payments. If you fall behind, default, or otherwise cannot pay off the loan, it backfires and leaves you worse off than you started.

Most credit builder loan programs are 1-2 years, though some will go up to ten years. We highly recommend avoiding those; short-term loans are much easier to handle, and it's much harder to predict your financial position a decade ahead of time.

Ideally, you will find a credit builder loan with 0% interest. This isn't always possible, though. APRs generally range from 4-5% on the low end to 25% on the high end.

Many credit builder loan servicers will also require a loan that has a particular minimum payment. This is usually somewhere in the $15 to $25 range, though some can be as much as $50. (Yes, our $100 per month example is higher than most actual credit builder loans.)

You will also want to take a look at any fees associated with the loan. Many credit builder loans will have one-time administrative fees, usually between $5 and $25, though some have additional monthly fees. It's usually best to avoid the latter if you can qualify for the former.

All in all, this will give you an idea of the capacity of the loan you can handle paying regularly. Then, you can look for credit builder loan programs that offer terms that match what you can pay.

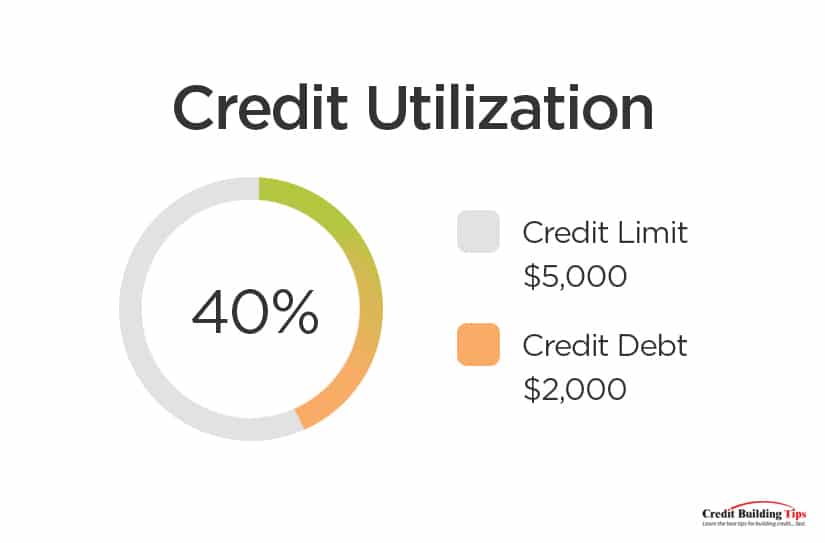

Remember: Bigger isn't necessarily better! A larger loan takes up more of your credit utilization and may hurt you somewhat in the short term while it builds credit in the long run. Take a loan you can comfortably pay off, not the biggest loan you may be able to pay off.

Remember: Bigger isn't necessarily better! A larger loan takes up more of your credit utilization and may hurt you somewhat in the short term while it builds credit in the long run. Take a loan you can comfortably pay off, not the biggest loan you may be able to pay off.Once you've chosen a loan, apply! Some lenders may have certain requirements to qualify, like minimum annual income, but most will not perform a credit check specifically because they cater to people with poor credit, so it doesn't matter.

Once you apply and are approved, all that's really left to do is make your regular monthly payments. If you have enough leeway to set money aside specifically for paying for the loan, do so. Otherwise, just make sure you have enough to pay it off each month. Since your loans should only last 12-24 months and usually have low numbers attached, this shouldn't be too hard of a burden.

As you successfully pay for your loan, your payments will be reported to the credit bureaus. This will have a slow impact on growing your credit score, often by 10-30 points, which will continue to grow as you pay off your loan. By the time the loan is done and paid off, many people with low credit see a jump of 60 points or so. Obviously, the exact amount that your credit score can increase will depend on your specific financial situation.

When you finish paying off your loan and close out the account, the balance of the loan will be returned to you. This is usually something less than the total value of the loan due to fees, interest, and so on. For example, a $1,200 loan will likely return something like $1,050 to you when all is said and done.

While this may feel like a windfall, especially if you're used to operating on thin, paycheck-to-paycheck margins, it's important to remember that this money should be handled responsibly. Whether it goes towards bills, paying off other debts, or is rolled into another credit builder loan, ideally, handling your money responsibly is part of growing your credit.

Additionally, it can be a good idea to check your credit score a few days or weeks after you finished paying off your loan. You are always able to check your credit score and can check your credit report for free once per year; doing so can show you that your payments were correctly processed, no errors have occurred, and that your credit score has risen accordingly.

As always, if you see any errors on your credit report, dispute them. It's hard enough maintaining a proper credit score without having misreporting or errors dragging you down.

Depending on your current financial situation, yes, it most certainly can be.

Credit builder loans are not without risk. If you take on more of a loan than you can reliably pay off, missed payments can hurt your credit score, eliminating the benefit you would be getting from the loan.

Additionally, if you have existing debt on credit cards or other loans, it's better to put your money towards paying them off rather than taking on another form of debt. Adding more debt won't improve your score as much as paying off existing high-interest debt.

All of that said, credit builder loans are often beneficial for those who have no credit or low credit and won't qualify for other forms of loan with favorable terms. They serve to help you reach a point where you can get to more favorable financial positions.

All of that said, credit builder loans are often beneficial for those who have no credit or low credit and won't qualify for other forms of loan with favorable terms. They serve to help you reach a point where you can get to more favorable financial positions.Do you have any questions or concerns about credit builder loans, or whether you should apply for one? If so, please feel free to reach out and contact us at any time! We'd be more than happy to answer any of your questions, and assist you on your credit building journey however we possibly can!

Bankruptcy is one of those processes that is rife with misinformation, misconceptions, and fear. It's a process you only ever encounter if you're in a bad position in the first place, and you're not in the right mindset or circumstances to fully understand what's going on. After all, the top causes of bankruptcy are:

All of which put significant strain on your emotions, cognitive processing ability, and stable living environment. If you're sick, if you're processing a devastating emotional change, or you've lost a job and are suffering the repercussions (or if you're dealing with any of those and putting the problem on a credit card), you're going to be in a bad place when it comes to learning about bankruptcy.

The truth is, bankruptcy isn't always as bad or as scary as many people make it out to be. That's why we're here; to help explain things in simple terms and guide you towards a positive solution.

The truth is, bankruptcy isn't always as bad or as scary as many people make it out to be. That's why we're here; to help explain things in simple terms and guide you towards a positive solution.Bankruptcy, as with any major financial change, has repercussions on your credit score. The question is, what are they, and how can you recover if you need to? Let's go through the most common questions people ask about the bankruptcy process.

You may have heard of different kinds of bankruptcy, like chapter 11 or chapter 7.

All of them are basically the same event: you recognize that, in your current situation, you are unable to pay the debts you have accrued, whether those debts are medical expenses, credit balances, a mortgage, or something else.

When you come to this realization, rather than trying to run from the debts or ignore them, you go before a judge and admit that you're in a financially insolvent position.

The judge can then make a determination of what to do, and can wipe out your debts, wipe some of them, or establish a plan to repay them on more plausible terms. Everything else is details.

Bankruptcy is often viewed as a "fresh start" and a way to get out from under crushing debts. While this is somewhat true, there are a few debts that will not be erased with a bankruptcy.

These include:

Additionally, bankruptcy wipes away debt but does not do anything to the causes that put you in debt in the first place. If it was poor financial decisions and bad habits that got you in over your head, you need to adjust your lifestyle accordingly; otherwise, you'll end up in the same place again.

That said, some causes of bankruptcy, such as going underwater on a mortgage due to the financial crisis, are often temporary or one-time events.

You've probably heard of different kinds of bankruptcy, referred to as chapters. What does this mean?

"Chapter" simply refers to which section of the U.S. bankruptcy code governs the situation. Different chapters are used in different situations. There are actually six different chapters of bankruptcy, though 99.99% of the people reading this will only ever likely be subject to two of them. The six are:

This is the most common kind of bankruptcy for individuals. In it, you go before the courts and declare that you cannot pay your debts. A meeting of creditors is called wherein you are grilled about your assets and financial situation, and a determination is made about what debts cannot be removed, what debts you want to reaffirm (like a car loan, to keep your car), and what debts you need to be removed if possible.

At the same time, the judge will go over your existing assets and determine what you can keep and what you should sell to pay your debts. This can leave you with very little, though many states have specific laws about what you have to be allowed to keep (like basic shelter), and any debts left over are removed.

Chapter 7 bankruptcies stay on your credit report for 10 years, and you can't file for another one for 8 years.

Chapter 7 bankruptcies stay on your credit report for 10 years, and you can't file for another one for 8 years.The chapter 13 bankruptcy process reorganizes and restructures your debt, establishing two things: a strict budget you have to adhere to for your spending and a payment plan to repay the debts you can. It's very strict but allows you to keep your assets in general, rather than liquidating everything you have to pay your debts.

This kind of bankruptcy is the second-most common for individuals, stays on your credit report for 7 years, and has a 2-year "cooldown" before you can file for it again.

This kind of bankruptcy is the second-most common for individuals, stays on your credit report for 7 years, and has a 2-year "cooldown" before you can file for it again.Chapter 11 is common to hear about because it's the kind of bankruptcy that companies file to protect themselves from their bad decisions. Unless you're a business owner, you don't need to concern yourself with this chapter.

The remaining three chapters are specific kinds of bankruptcy for narrow groups of people. They are:

As you can see, there's a pretty low chance you'll have to deal with any of these, so we're not covering them in detail here. If you have a specific need to learn more, though, feel free to reach out or leave a comment, and we'll do our best to help. Remember, though; we aren't bankruptcy lawyers, so we can only offer so much guidance.

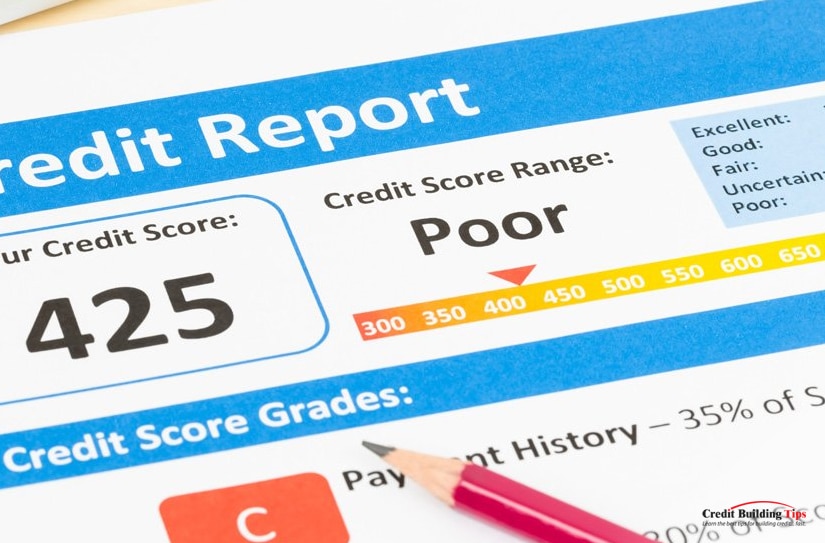

When you declare bankruptcy, as you might expect, your credit score will take a hit. It is one of the most significant detrimental hits you can take.

Remember, your credit score is a rating based on many factors, but it's aimed at telling creditors how well you can pay your debts. Declaring bankruptcy is a straight-up admission that you can't pay your debts. No matter how good your credit score was before your declaration, your credit score will take a huge hit.

Remember, your credit score is a rating based on many factors, but it's aimed at telling creditors how well you can pay your debts. Declaring bankruptcy is a straight-up admission that you can't pay your debts. No matter how good your credit score was before your declaration, your credit score will take a huge hit.

Various reports and records indicate that if your credit score is good – 700 or higher – declaring bankruptcy can cause it to drop by 200 points or more. That's a lot! If your credit score is lower, you'll see a drop of around 150 points. It's an extremely substantial hit, and since bankruptcies stay on your credit report for 7-10 years, that hit will follow you for a long time.

In truth, different kinds of bankruptcy can have different levels of impact on your credit report and score. This is because the determining factor is how able you are to pay back your debts. In a chapter 7 bankruptcy, you are paying little or nothing towards your debts, and most of your debts are wiped away. The creditors need to take that hit, and they hate doing that. So, a Chapter 7 bankruptcy is going to be worse.

Meanwhile, a Chapter 13 bankruptcy, while still devastating, isn't quite as bad. This is because the core of a Chapter 13 declaration is a reorganization of your finances, such that you can then pay what you can to furnish your debts. The impact on your credit will still be severe, but it won't be quite as severe as with a Chapter 7 declaration.

Let's say that, 7-10 years ago, you had severe unexpected medical issues and struggled to pay your medical debts. Disregarding commentary about the absolute failure of the medical system to allow this, you end up needing to declare bankruptcy to get out from under those crushing debts. Since then, you've spent time recovering, both physically and financially. What happens to your credit score?

Well, assuming you haven't fallen into old habits and racked up even more debt you can't pay, chances are that your credit score has slowly been improving over the intervening 7-10 years. Good financial habits, lower amounts of debt, and consistent repayments as applicable according to a bankruptcy filing can all help improve your score, though it won't reach the heights it was before for quite a while.

Well, assuming you haven't fallen into old habits and racked up even more debt you can't pay, chances are that your credit score has slowly been improving over the intervening 7-10 years. Good financial habits, lower amounts of debt, and consistent repayments as applicable according to a bankruptcy filing can all help improve your score, though it won't reach the heights it was before for quite a while.

When your bankruptcy finally falls off of your credit report, you will see some increase in your score. However, this might not be a "full" restoration for a few reasons.

Generally, when your bankruptcy falls off of your credit report, your score will increase, usually by somewhere between 30 to 100 points. This may seem like a huge increase, but it's still relatively small compared to the decrease that the bankruptcy caused in the first place.

It's entirely possible to recover to your previous score or even get a better score than before, but it will likely take quite a number of years. You need to not only let your previous debts, defaults, and bankruptcy age out; you need to establish a history of positive payments in the intervening time. You may be looking at 15-20 years before you can truly be considered recovered.

Yes, of course. However, some of the options available to most people will not be available to you. For example, here are several tips given to improve credit scores:

These are not generally available to you. When you declare bankruptcy, many of your existing lines of credit will be closed, and you will generally be denied for higher credit limits (since you've proven you can't handle what you have now). Likewise, opening a new line of credit for a balance transfer will generally be denied. Indeed, with a lower credit score and a bankruptcy on file, you will be denied for most lines of credit, and the ones you can get will have much worse terms.

If this seems unfair, well, it kind of is.

That said, there are still ways to improve your credit score even while your bankruptcy is still on file.

You can always work to improve your score, no matter what your financial situation may be.

Defaulting on a loan means violating terms and not paying it. When you default, the creditor may pursue you for payments, and they can even sue you for the balance. Alternatively, they can sell the debt to a collection agency and let them worry about it.

Most people default on their debts prior to declaring bankruptcy. In fact, not defaulting may reflect poorly on you, as you're "jumping the gun" on declaring bankruptcy rather than giving your situation as much time as possible to remain solvent.

If you can default on one or two debts and successfully pay the others, you will likely be in a better position regarding your credit score than you would with a full bankruptcy. The hit you take from declaring bankruptcy is just that bad.

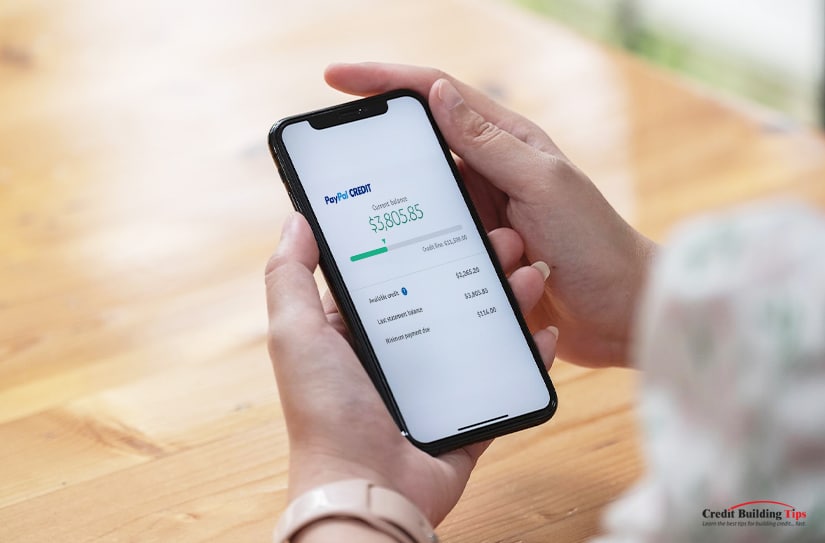

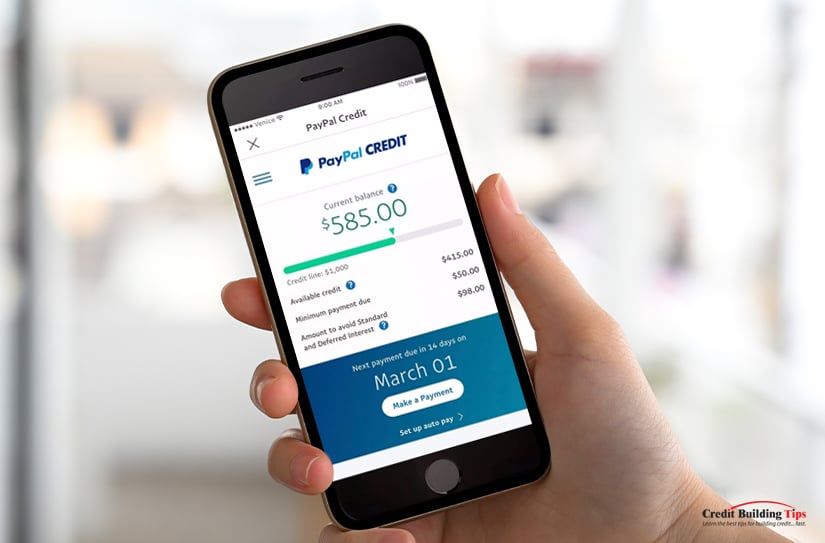

PayPal is one of the largest non-bank financial institutions available to consumers around the world. Though they have had their ups and downs over the years, they are used and trusted by millions of people, and many of those people take advantage of the various financial offerings PayPal opens to its users.

One such offering is PayPal Credit. Despite not being a bank, PayPal offers lines of credit to users who qualify. Who qualifies, and are there any other details you should know?

PayPal Credit is a revolving line of credit, meaning it functions just like a credit card.

Where most credit cards are backed by a common bank, PayPal's credit card is backed by Synchrony Financial.

Synchrony Financial is a bank that was started in 1932, as a GE-branded bank offering credit to people during the Great Depression in order to purchase GE appliances. It remained a GE-branded bank until 2014, when the lending arm was spun off into Synchrony Financial.

Today, Synchrony Financial is the largest bank offering private label credit cards. That is, credit cards that aren't attached to a bank like Capital One, Bank of America, or a simple Visa without branding. Store-brand credit cards like those offered by Amazon, Lowe's, Gap, and Verizon are all Synchrony cards.

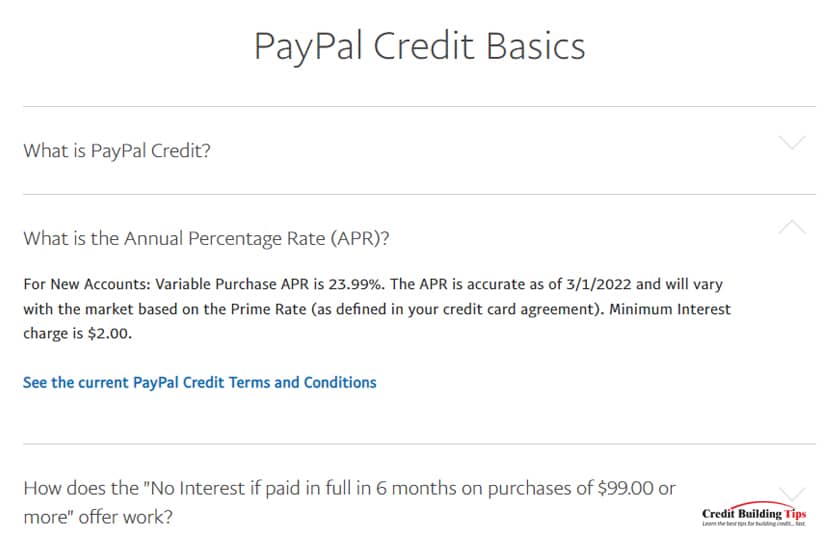

APR – the Annual Percentage Rate, or interest rate of a card – is somewhere around 24%. The specific number changes over time as a reflection of the markets. You can find the specific rate in the PayPal Credit FAQ, found here.

Is this a good APR?

Not really. The definition of a "good" APR is anything at or below the industry average. Currently, the industry average is closer to 16%, meaning PayPal's APR is higher than average.

Not really. The definition of a "good" APR is anything at or below the industry average. Currently, the industry average is closer to 16%, meaning PayPal's APR is higher than average.It's unclear whether or not individuals with a higher credit score, or those with greater usage of PayPal, will have a better rate. Given that they mentioned a rate in their FAQ and make no mention of it varying, and that many customers are reporting a 23.99% APR, it seems unlikely.

Additionally, PayPal Credit has a minimum interest charge of $2.

Like all credit cards, PayPal credit has a limit on individual lines of credit. This limit varies based on your credit score and starts at a meager $250. This means it's very easy to open a line of credit with a large purchase and immediately have a high credit utilization percentage. Depending on the rest of your credit report, this can have a detrimental effect on your credit score, at least until you pay off the purchase.

PayPal does not seem to mention the upper bound on their lines of credit, but according to an interview with their VP of consumer credit here, the upper limit is $20,000. Relatively few people will want or need such a high limit, of course.

The determination of what your credit limit will be involves your history of activity with PayPal, your credit score and report, your annual post-taxes income, and other credit factors that PayPal does not disclose.

To increase your credit limit, you will need to call PayPal and request an increase, whereupon they will review your account situation and determine if and how much of an increase you qualify for. Additionally, Synchrony Financial will occasionally increase credit limits for users they deem to qualify for one as part of an automatic process to foster further use and engagement with their cards.

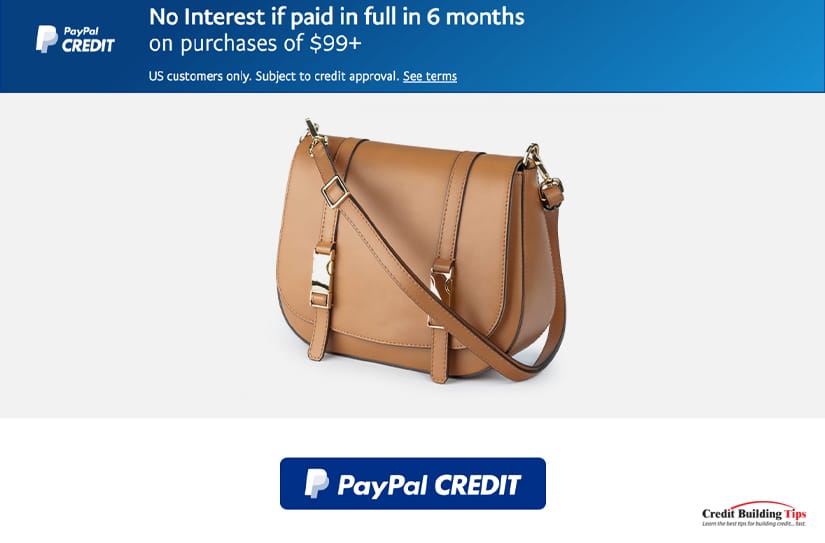

One of the main draws PayPal offers people is an offer wherein any purchase of $99 or more made with PayPal Credit will have 0% interest for six months. If the purchase you make is paid off in full within six months, you will not be charged any interest.

However, if there is any balance at all remaining after six months, any interest you would have owed will be added to your balance. This can be a very large amount of money relative to your remaining balance, especially for larger purchases. Interest remains calculated based on the balance you have each month, the interest is merely waived if you pay the principal in full.

This is not an introductory offer; that is, it doesn't simply apply to the first large purchase you make. It applies to any purchase over $99 you make with PayPal credit. For some, this is a compelling draw; for others, it's a trap. Exercise due caution when relying on lower payments and interest-free repayment.

PayPal does not publicly disclose the minimum credit score necessary to qualify for a PayPal Credit line. However, numerous polls and interviews online indicate that the minimum is 600. Anyone under 600 is considered sub-prime by PayPal and will not qualify for a line of credit, though PayPal's automated systems will still likely make the offer to check.

PayPal does not publicly disclose the minimum credit score necessary to qualify for a PayPal Credit line. However, numerous polls and interviews online indicate that the minimum is 600. Anyone under 600 is considered sub-prime by PayPal and will not qualify for a line of credit, though PayPal's automated systems will still likely make the offer to check.As with most lines of credit, the higher your credit score is, the more you'll be able to access higher credit limits, and the lower your interest rate may be. It's unclear how much of an effect it will have right away, other than whether or not you qualify.

For the best terms, most people recommend at least 700.

A minimum credit score is not all that will be necessary to qualify. PayPal also considers your existing debt, credit utilization, and even your income to determine whether or not you qualify. The process is fast and automated – it's designed to work mid-purchase – but it still asks for specific information and authorization to check your credit report.

A balance transfer is a way of shifting debt from one credit line to another. Essentially, you use a credit card to pay off a different credit card. This is usually used to move a balance from a high-interest credit card to a lower-interest credit card or potentially to consolidate debts across several lines into one line.

To avoid being exploited, many credit cards will have special terms for balance transfers, including a requirement to pay off a chunk of the balance being transferred (up to 3-5%) in order to transfer it.

PayPal credit does not offer balance transfers. Of course, since PayPal credit also does not have an introductory 0% interest rate and indeed has a very high interest rate in the first place, there's little reason to want to transfer a balance to PayPal in any case.

PayPal credit does not offer balance transfers. Of course, since PayPal credit also does not have an introductory 0% interest rate and indeed has a very high interest rate in the first place, there's little reason to want to transfer a balance to PayPal in any case.Likewise, PayPal does not allow you to transfer a PayPal balance to another line of credit. You are only allowed to pay for PayPal credit purchases using funds in your PayPal account or in your bank account that is linked to PayPal. It is, in effect, an isolated line of credit tied solely to PayPal.

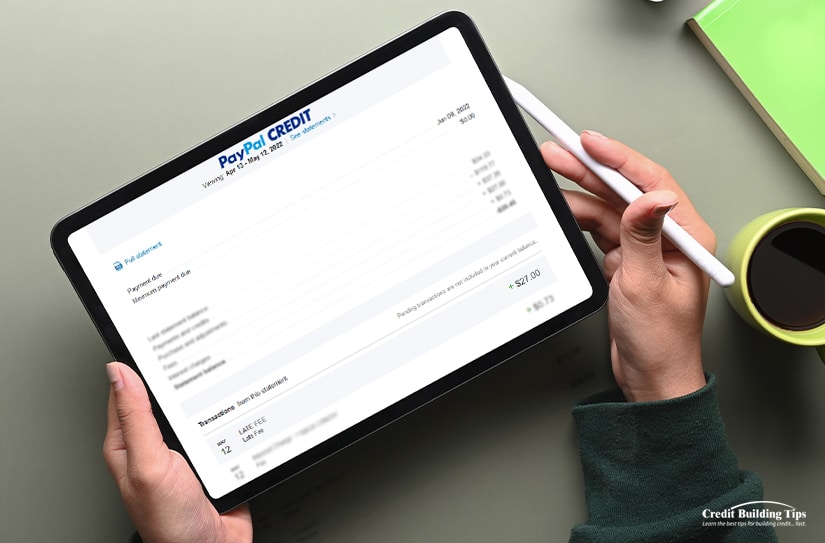

Yes. PayPal credit has late fees if you fail to make a payment on a balance. The fees are currently $30 if you have not had a late payment in the past six months or $41 if you have.

That said, PayPal cuts you some slack if your balance is low; they won't charge you a late fee greater than your outstanding balance. So, if you only have $20 on your credit line and are late in paying it, the late fee will be no greater than $20. Some people report that they simply won't charge a late fee, but PayPal doesn't state this outright.

PayPal Payment Security is essentially an insurance policy for your credit line.

It is an optional, additional purchase you can make whenever you make a large purchase using your PayPal credit. Payment Security costs $1.66 for every $100 of balance on your line of credit. This is calculated and charged as part of your minimum payments each month.

What does it do?

If you encounter a qualifying life event that makes you unable to pay your minimum payments or your overall balance, PayPal will either cover your minimum payments or will waive the balance on your line of credit, up to $10,000. This is a way to protect you from late fees, a hit to your credit report, and undue expenses in certain circumstances.

If you encounter a qualifying life event that makes you unable to pay your minimum payments or your overall balance, PayPal will either cover your minimum payments or will waive the balance on your line of credit, up to $10,000. This is a way to protect you from late fees, a hit to your credit report, and undue expenses in certain circumstances.Qualifying life events are unemployment, hospitalization, leave of absence from work, disability, nursing home care, terminal illness, and loss of life.

If you suffer from one of these, you (or your next of kin, in the case of the lost life event) will need to contact PayPal and file for payment security. The claim will be processed, and appropriate action will be taken to alleviate the financial strain caused by your PayPal balance and minimum payments.

The full terms of the agreement can be found here.

As with any line of credit, PayPal Credit has the potential to both help and hurt your credit score.

Often, PayPal Credit will initially hurt your credit score. This is because the credit balance is low. Here's a scenario:

Imagine that you have one credit card with a $1000 limit and $300 on it. This is a 30% credit utilization, which is the highest that can still be considered good.

Now, you want to make a $200 purchase and open a PayPal Credit line to do it. PayPal gives you a $250 credit limit.

With this new purchase and new line of credit, you now have a total balance of $500 and a total credit limit of $1250. You are now at 40% credit utilization, which is considered worse than 30%. This will, in all likelihood, hurt your credit score by a couple of points.

It's not a meaningful drop, but it's still a drop. It will recover as you pay off your debts, of course. And, like any line of credit, if you fail to make payments on time or you stop making payments entirely, your account will fall into delinquency, and your credit score will be harmed for it.

In the past, PayPal didn't report to the credit bureaus. However, today they do, and they report to all three of the FICO bureaus; Experian, Equifax, and TransUnion.

In the past, PayPal didn't report to the credit bureaus. However, today they do, and they report to all three of the FICO bureaus; Experian, Equifax, and TransUnion.On the other hand, PayPal Credit can potentially help your credit score as well. This is because, as a line of credit, it helps you work towards a lower credit utilization percentage. It also helps you generate a history of on-time payments.

When it comes down to it, whether or not PayPal credit will help or hurt your score depends on you; it's no different than any other credit card in that respect.

Truthfully, if you're looking to build your credit, you can find much better options. PayPal's lack of introductory offer, the risk of a massive unexpected interest liability with their no interest for six months deal, and their high APR are all potential issues.

Truthfully, if you're looking to build your credit, you can find much better options. PayPal's lack of introductory offer, the risk of a massive unexpected interest liability with their no interest for six months deal, and their high APR are all potential issues.There are better ways to build credit, there are better credit cards (even for those with sub-prime credit), and there are better credit cards for those with higher credit scores as well.

The primary advantage to using PayPal Credit is simply that it's attached to PayPal, and PayPal is already an incredibly convenient, accepted-everywhere form of paying for something, particularly online. PayPal credit mostly just allows you to use PayPal in offline venues where a credit card works but not an online payment processor. The fact that it's easily linked to your PayPal account and any bank accounts linked to PayPal is icing on the cake.

PayPal credit isn't exploitative any more than any credit program. Nor is it particularly egregious. It's simply a credit line with a high APR and not particularly favorable terms. If you want to use it and you're aware of the risks of unexpected interest, it's not a bad card to get. However, if you're serious about improving your credit score and using beneficial lines of credit, there are much better options available to you.

After reading all about PayPal credit and how it works, do you have any questions about it? Was there anything that we mentioned today that you'd like any additional information on? If so, please feel free to reach out and contact us at any time! We'd be more than happy to assist you in all things credit-related however we possibly can!

Your credit score is a measure of your ability to pay bills on time and pay off debts you accrue. We all accumulate debts, whether it's from regular usage of a credit card or major purchases like a car loan or home mortgage. Credit is simply a system used by financial institutions to minimize their own risk with lending to people who won't repay that loan.

This is all important information because it can help you understand not just the importance of your credit score, but the limitations of what it covers.

Many people tend to think of their credit score as an all-encompassing measure of their financial responsibility. That's not true. Rather, it's a measure of their responsibility with debt. Many things that you might think should go onto your credit report do not, such as:

So, there are quite a few aspects of your overall financial situation that aren't included in your credit score calculation.

What about overdrafting? On the one hand, overdrafting incurs penalties and fees and can cause other problems, and "not having money" is a pretty strong indicator of an inability to pay debts. On the other hand, there are many reasons why an overdraft might be misrepresentative of a situation. Let's take a closer look.

If you're fortunate enough to have never been in a situation where overdrafting your account is a concern – or if you're down on your luck and facing the possibility for the first time – you might want to know more about it. If you're already familiar with overdrafting (for better or for worse), you can skip to the next section.

Overdrafting is a phenomenon that happens specifically to checking accounts and variations thereof. If you pay for a purchase using a credit card, you then owe the credit company money, which you can pay off all at once or over time. When you make a purchase using an ACH payment from a checking account or using a debit card, you're paying with your own money directly.

Overdrafting is a phenomenon that happens specifically to checking accounts and variations thereof. If you pay for a purchase using a credit card, you then owe the credit company money, which you can pay off all at once or over time. When you make a purchase using an ACH payment from a checking account or using a debit card, you're paying with your own money directly.Credit allows you to make purchases that would be larger than the money you have available and helps you distribute the payments out over time to make them more manageable. If you need to pay $500 for an emergency and you only have $400 in your checking account, you're going to have trouble. With credit, you put the $500 on credit and can pay it off over several months.

Looking back at checking, though; in many situations, a bank will allow for some flexibility. If you have $95 in your checking account and you try to make a purchase for $100, it may be approved. The bank is good for it, after all; they just need to recoup that money from you.

Paying with money you don't have in this manner is called overdrafting. It pushes your bank balance into the negatives and may have other repercussions. Banks do this to avoid issues with denying payments or "bouncing checks," so to speak.

Different banks handle overdrafting in different ways, and many will give you options such as overdraft protection, linked accounts, or hard limits. You may be able to tell your bank to deny any purchase that would overdraft an account. You may tell it to automatically pull the excess money from a linked savings account.

If you expect to pay for a purchase with money you don't have, shouldn't you use a credit card for it? Why is overdrafting allowed in the first place?

Generally, overdrafting offers a grace period. It might be 3/5/7 days, or it might be longer, depending on the bank. It is, essentially, a way to smooth out problems that occur when you're living paycheck to paycheck. If your bills are due on Thursday and your paycheck doesn't come in until Monday, what do you do? Overdrafting allows you to still pay those bills, knowing the money will be in your account within a couple of days.

Overdrafting generally only becomes a problem if your account remains negative for some time or if your financial institution has penalties for going negative.

Overdrafting generally only becomes a problem if your account remains negative for some time or if your financial institution has penalties for going negative.It doesn't really make sense to charge someone a fee for not having money, but here we are.

When you take out a loan or use a credit card to make a purchase, you borrow money from someone and are responsible for repaying it. This activity is tracked on your credit score.

When you make a payment using your checking account, you're not borrowing money from anyone. Thus, checking account activity is generally not reported to the credit bureaus.

When you overdraft your account, you're technically borrowing money from the bank to pay for the purchase, but it's not an official loan agreement. When you bring your account positive again, you automatically settle up with the bank. There's no actual borrowing or loan happening, so this is not reported on your credit score either.

There are, however, several situations wherein an overdraft could affect your credit score.

The first situation is where you simply abandon your overdrawn bank account. Overdraft fees stack up, automatic payments fail, you get in over your head. Mafia enforcers start coming for you, your kneecaps quiver in fear, and you fake your own death to move to Bolivia.

Your bank, unable to find you or get you to pay, decides to wash its hands of the debt. They sell it to a debt collector for pennies on the dollar, and the debt collector begins to pursue you. As part of their Comprehensive Threat Package (Platinum Plan), they report the debt to the credit bureaus. The presence of a debt in collections, regardless of where it came from, is enough to hurt your credit score.

Your bank, unable to find you or get you to pay, decides to wash its hands of the debt. They sell it to a debt collector for pennies on the dollar, and the debt collector begins to pursue you. As part of their Comprehensive Threat Package (Platinum Plan), they report the debt to the credit bureaus. The presence of a debt in collections, regardless of where it came from, is enough to hurt your credit score.Okay, so we're being a little tongue in cheek here. You're not faking your own death over a $5 overdraft, clearly. But, the fact remains; if you fall into any kind of debt for long enough that the debt is sent to collections, the collections agency is highly likely to report it to the credit bureaus so they can apply more pressure to get you to pay.

This is one baked-in bit of unfairness in the credit system, in fact. Operating a checking account for decades with no blemishes will not have even a smidge of positive impact on your FICO score. But, if something goes wrong and an account falls delinquent, it will hurt your score.

Another way in which overdrafting might hurt your credit score is if it causes a cascading failure. A common example is using checks.

If you write a check for money in your account and use that check to pay a bill, but your account overdrafts or falls under the amount of money prior to the check being cashed, the check will bounce. The bill the check was meant to pay doesn't get paid, you fall into late payment status, and eventually into delinquent account status. Fees rack up, and over time, those accounts can also be sold to debt collectors. This will hurt your credit.

If you write a check for money in your account and use that check to pay a bill, but your account overdrafts or falls under the amount of money prior to the check being cashed, the check will bounce. The bill the check was meant to pay doesn't get paid, you fall into late payment status, and eventually into delinquent account status. Fees rack up, and over time, those accounts can also be sold to debt collectors. This will hurt your credit.You don't have to be using checks for this to happen. It largely depends on the bank and the bank's policies for your account. If they will pay your bills and overdraft you more and more, then it sucks for your bank account, but it prevents other accounts from falling delinquent as well. It becomes a sort of sub-prime credit card situation, in a way.

On the other hand, if your bank puts a stop to any new purchases or payment authorizations when you overdraft, those other bills will fail to get paid and can fall into late fees and delinquent status themselves. These all end up reported on your credit score, though it generally takes a couple of billing cycles for this to kick in, assuming you have a grace period active.

Above, one thing we mentioned about the credit system is that there are many kinds of bills that you can pay regularly but which aren't tracked and don't reflect on your credit score. There are, however, many systems you can use that essentially convert those payments into limited credit payments, essentially by giving you a secured, restricted line of credit and setting up automatic payments.

These are called credit builder programs, and they come in many forms. You can read our full rundown at that link.

The benefit to these systems is that they give you credit for paying regular bills that otherwise wouldn't be reported.

The downside is that if you are unable to pay for some reason – like your account falling into overdraft territory – it can fall into late payments and end up reported on your credit score. It's one of the few downsides to using a credit builder program. Credit builder programs only build your credit if you can prove you can repay a loan, obviously.

The downside is that if you are unable to pay for some reason – like your account falling into overdraft territory – it can fall into late payments and end up reported on your credit score. It's one of the few downsides to using a credit builder program. Credit builder programs only build your credit if you can prove you can repay a loan, obviously.Other than these few situations, however, an overdrawn bank account won't actually be reflected on your credit score, as long as you can still manage to pay all of your debts on time.

One thing to note before we close out on this discussion is that even though your credit score doesn't care whether or not you overdraft your bank account, other financial tracking systems do.

In addition to the variety of different non-FICO credit scores, there are systems out there that track your financial activity in much greater detail. They aren't used quite as frequently or in as widespread a set of ways, but they can still be impactful.

There are several different bureaus tracking this data, but the biggest is known as ChexSystems. ChexSystems (no relation to the cereal) tracks your bank and credit union activity in much greater detail, including monitoring things like deposits, spending activity, fraud, unpaid balances, involuntary account closures, and more.

At the same time, all they care about is your deposit accounts – that is, your checking and savings – and they don't pay attention to your debt accounts like your credit cards. The two scores, ChexSystems and FICO, are distinct and track different aspects of your financial situation.

All of this data goes into their proprietary report, which is then used by other banks and credit unions. When you go to open a new bank account, the bank or credit union will generally check your ChexSystems report. If they see a history of irresponsible activity, they may deny you the account.

Note: It's fully possible to take action to clean up your ChexSystems report. Much like your credit report, you can pull your ChexSystems report for free once a year, per government mandate. You can then go through a similar process of disputing incorrect information and other strategies to clean it up. More on that another time, though.

Note: It's fully possible to take action to clean up your ChexSystems report. Much like your credit report, you can pull your ChexSystems report for free once a year, per government mandate. You can then go through a similar process of disputing incorrect information and other strategies to clean it up. More on that another time, though.Some banks have special accounts, usually with stricter limits or fees, which they will offer to people with bad ChexSystems accounts. Others simply won't work with people below a certain threshold. It varies from institution to institution.

So, there you have it. Overdrawing your checking account and ending up with a negative balance won't affect your FICO credit score unless it triggers other issues, like bounced payments for credit accounts. That's not to say they aren't bad, though. You still need to figure out any issues that led to the overdraft in the first place, pay any outstanding bills, and catch up financially. If it's a rare occasion, it probably won't hurt you long-term once you get it sorted out. If you overdraft too frequently, though, you may run into other issues down the road.

Do you have any specific questions about overdrafts pushing your checking account into the negative? We'll do the best we can to answer them, but we need you to ask them, so we know what to discuss next.

Credit card owners have to keep track of two important dates, and it's extremely easy to get them confused or not know what they mean. Financial literacy is important, so we're doing our part to help keep you educated about everything from the most basic info to advanced financial strategies. This one is, of course, on the more basic end of the spectrum.

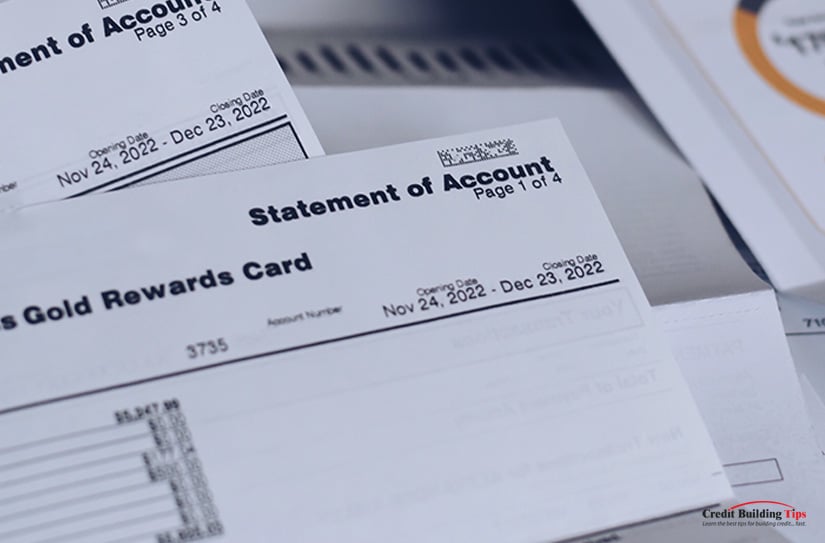

The two dates are the closing date and the due date. What are they, and why are they important?

Credit cards operate on a billing cycle. The specific length of a billing cycle varies from credit card issuer to issuer. However, to avoid undue confusion and to enforce standardization, the government requires that the billing cycle be consistent, with no more than four days of variance. This is mostly just to allow for the difference in lengths of months.

Thus, you will often end up with billing cycles from the first of one month to the first of the next month, or from the first Monday of one month to the first Monday of the next month, and so on.

The day at which a billing cycle ends is the closing date for that billing cycle. At this point, your outstanding balance is calculated, and you are sent the billing statement for your credit card.

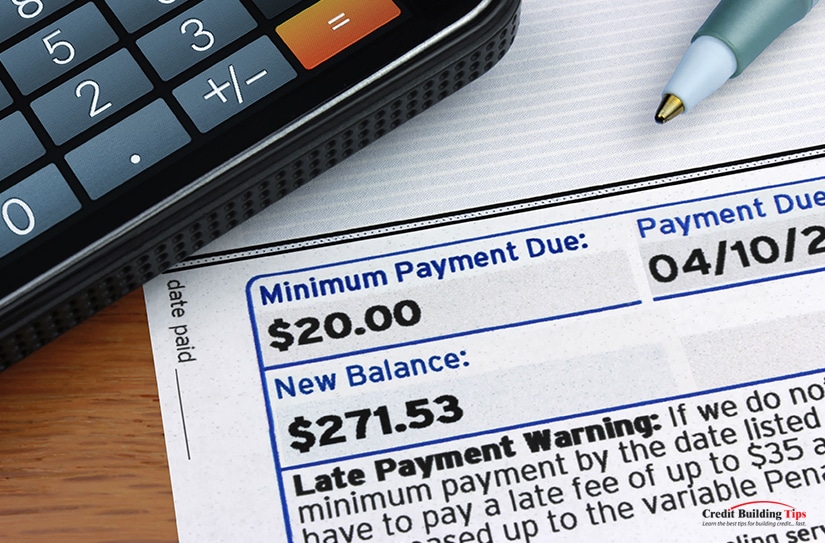

The day at which a billing cycle ends is the closing date for that billing cycle. At this point, your outstanding balance is calculated, and you are sent the billing statement for your credit card.Any charges and payments made and any interest added to your account on ongoing balances are calculated. Your minimum payment is calculated and sent to you in your billing statement.

As you might expect, the due date is the date at which your credit card expects to receive money. You can, of course, pay any time earlier, including immediately after making a purchase on your credit card.

The due date is the date at which your account may be considered late and where interest will accumulate on the balance on your card.

The due date is the date at which your account may be considered late and where interest will accumulate on the balance on your card.Due dates are generally around three weeks after the closing date for your credit card. The exact amount of time varies from issuer to issuer.

According to The Balance, the time between them for major issuers is:

Many of these are "up to" or "minimum of," but the grace period is somewhere around three to four weeks. During this time, interest is not added to accounts in good standing.

The due date is generally much more flexible than the closing date of a credit card. Closing dates need to be regular for the computer programs to properly calculate interest rates and payment minimums, and to issue statements to the people who have balances to pay. Due dates, however, can involve flexibility with grace periods and payment terms that work as a benefit for account holders in good standing.

Grace periods are not legally-mandated, but every major credit card issuer offers one of around the same amount of time. This time allows you to receive your credit statement, determine how much you can afford to pay towards it (if you're paying somewhere between the minimum payment and the full balance), wait for a paycheck to clear, and potentially reach out to negotiate terms if you're in dire financial straits.

Your credit card grace period is the time between the closing date and the due date.

Your credit card grace period is the time between the closing date and the due date.For individuals whose accounts are in good standing, the grace period is generally interest-free. Interest on your balance is calculated either if you miss the payment or when the next billing cycle closes. Interest is also calculated on outstanding balances when you are paying the minimum, but won't kick in until the end of the grace period or the following billing cycle. These terms can vary depending on the issuer and the specific credit card, as well.

What is most interesting is that grace periods are not required. However, if your credit card company chooses to offer a grace period – and almost all of them do – federal law mandates that it must be at least 21 days.

"Although credit card issuers are not required to offer a grace period, those that do must provide a minimum of 21 days under federal law. That means cardholders will have at least three weeks to pay off any purchases they made during a billing cycle, and if they do, they can avoid interest." – US News.

Some credit cards offer much longer grace periods, up to as much as 55 days. It's often considered a benefit for account holders in good standing to go longer without interest accruing on their balances.

Grace periods are harder to find on credit cards specifically created and issued to people with subprime credit. It's yet another way that financial institutions insulate themselves from risk from individuals whose credit indicates a lower chance of paying their bills. Along with lower credit limits and higher interest rates, these are reasons why you should strive to raise your credit as much as you can. Please, check out the rest of our blog if your credit is low to find more tips for raising your credit quickly and with a minimum amount of effort and expense.

It's also worth mentioning that you can lose your grace period if your account falls out of good standing. Conversely, if you bring your account back into good standing, your issuer may restore your grace period. As with most things, these will likely be defined in the terms of use for your credit card, but you can always call your credit issuer to ask for their policies in plain English if reading the fine print is too much for you.

Generally, when you apply for and are approved for a credit card, the credit card company sets your closing and due dates based on their policies and the date you opened the card. There's often no fixed date where everyone has to pay, though many credit card companies pick simple days to track, like the first of the month or the first Wednesday of the month.

Can you change these days? The answer is: maybe.

Sometimes, you can talk to your credit card company and ask them if you can change the due date for your credit card. Depending on your account's standing, length of history, and other factors, they may or may not be willing to entertain the idea. Generally, if you can make a good argument such as "the due date is right before my paycheck date," you may be able to persuade them to push it back a few days or a week to ensure you're more consistently able to pay your credit card bills.

You can also negotiate other aspects of your credit card, such as interest rates and credit limits. That's outside the scope of this post, however.

Closing dates may or may not be fixed, and it will, again, depend on the issuer. Some are stricter about their terms than others. However, it never hurts to call them up and ask about shifting terms, just in case. The longer your account has been in good standing, the more likely they are to cut you some slack.

When paying off your credit card balance, you have a lot of options and flexibility.

The truth is, any time you can pay your credit card bill before the due date is fine. There are minor benefits to paying earlier or proactively, but the biggest, most important thing is to not miss your due date. That's when late payments happen, when penalties and interest kick in, and when you may need to consider something like a goodwill letter to remove a blemish from your credit report.

The truth is, any time you can pay your credit card bill before the due date is fine. There are minor benefits to paying earlier or proactively, but the biggest, most important thing is to not miss your due date. That's when late payments happen, when penalties and interest kick in, and when you may need to consider something like a goodwill letter to remove a blemish from your credit report.

In general, the best advice for using a credit card is to always treat it as if it's a debit card and only make purchases that you can afford to pay in full. Credit card limits are best used as buffer and emergency leeway in the case of an exceptional emergency or large purchase that would otherwise take several months to save for. Of course, whatever method you use that works for you is fine, so long as you don't fail to pay your balance and you are aware of the detrimental effect of interest accruing on outstanding balances.

One common belief is that, to build credit, you need to have an ongoing balance on your credit card.

The truth is, this is not true. Carrying a balance on your credit card increases your credit utilization, even if it's only a small percentage. The more credit utilization you have, the lower your credit score can be in that category.

The truth is, this is not true. Carrying a balance on your credit card increases your credit utilization, even if it's only a small percentage. The more credit utilization you have, the lower your credit score can be in that category.Meanwhile, carrying a balance runs the risk of accruing interest and fees, especially if you don't frequently use the credit card and accidentally miss a payment. It's a lot of additional work to maintain for no benefit whatsoever.

It is always better to pay off your credit card debt than to let some of it ride if you don't have to.

Some people might fear that they may have a fee for letting their credit cards go unused. Such fees, called dormancy fees, are illegal in the United States and have been for quite some time. The worst that can happen is that a credit card issuer might view an unused credit card as unnecessary and, if it's left unused indefinitely, close it. Generally, they will send you notice of their intent to close the account ahead of time, so you can start to use it again to keep it alive.

Do you have any other questions about credit card mechanics, terminology, or optimization? What about how they interact with your credit score? We're here to help you out, educate you on the best way to manage your credit cards and credit score, and help pave the way for you to achieve a high credit rating and credit report. Everyone deserves a financial opportunity, and often, all it takes to get there is a little knowledge.

If you have any specific questions or concerns, feel free to ask them in the comments. We'll do what we can to answer, educate, and even write whole guides on the subject, as relevant. We're here to help, but we can only do that when you let us know what you need. Let our tips help guide you to a great credit score! We greatly look forward to assisting you on your credit building journey however we possibly can!

Your credit score is made up of five primary factors. You've probably seen this breakdown before:

Most of these can be controlled, but one stands out: the length of credit history.

Building credit happens over time, and the longer your credit history, the better. Except, that's not purely true, or young people would never have good credit, and older people would have better credit as a baseline.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.

The length of your credit history accounts for roughly 15% of your score calculation, but that's not a very helpful description. You know that credit history is important but not what makes a good credit history.So, how long is long enough? What is a "good" length for your credit history? Is there a cap? Let's dig in.

Did you know that there's a minimum age to have a credit score?

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.

Technically, the minimum age is 18 throughout the U.S. in order to start gaining credit. That's because you have to be 18 to open up lines of credit, qualify for loans, and have your own major assets in your own name.There are exceptions, though. If you're younger than 18, you can still be added as an authorized user on someone else's credit card (usually your parents') and start building a credit history earlier. There's technically no minimum age here, but most credit card companies will limit it to 16 or so.

Sometimes you can have a longer credit history if a credit reporting bureau started tracking you erroneously. This can happen both out of mistakes and due to identity theft. Unfortunately, the added benefit of a slightly longer history here isn't going to outweigh the issues caused by identity theft, at least until you get them figured out.

There's also a minimum length for how long of a credit history you have before you even get assigned a credit score.

Contrary to what some people believe, you don't get a credit score immediately.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.

The minimum age for a credit history is six months. That is, if you open a credit card on your 18th birthday, it will be six months after your birthday before you are assigned a score based on credit factors.It won't be a great score since you don't have a mixture of credit scours or a long history of on-time payments, but it will be a starting score.

Credit scores are highly variable and easily influenced when they're relatively new. That's because there's so little data to them, so even small changes can have an outsized effect on the whole.

Just like how if you have $1, giving you a quarter will be a significant increase in money, but if you have $100, a quarter is barely anything.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.

The "training wheels" period for credit scores is around 2-4 years. That is, you have to have been building credit for 2-4 years before your score starts to reach a point where it settles down and becomes somewhat harder to influence.We say "somewhat" harder here because your credit score is always relatively easy to influence if you know what you're doing and take the right actions. This entire website is predicated on teaching you how to do exactly that, after all.

Before two years of credit history, you don't have a lot established. Creditors looking at your credit history can't see a long line of on-time payments because you haven't had a score long enough to even be making payments.

Each factor in a credit score has an "ideal" or "best" range to hit. For example, the number of late payments should be zero, and the percentage of utilized credit should be under 30%.

So, is there a "best" point for the age of your credit history? Yes and no.

Most people consider a credit history to be fully matured at around ten years. That means you can't get a "perfect" score on your credit history until you're at least 28 years old, assuming you started from scratch at age 18. Obviously, this can be lowered slightly if you took advantage of loopholes like being an authorized user at 16.

Some creditors will say seven years is good enough, as well. That means the youngest feasible age to have a "mature" credit score is 23, assuming you started early. On average, though, this is relatively uncommon.

Another age-related factor you might have heard before is that negative marks and blemishes on your credit report will drop off after seven years.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.

This is a little tricky to conceptualize, and it won't affect everyone. It's specifically for delinquent accounts and the report on your credit history that payments were missed.For example, say that you miss a single payment on a car loan, and it's late by over 30 days. You then pay it, but the blemish remains; you were reported to have missed a payment. That blemish hurts your credit, but if your overall credit report is positive, it won't be devastating.

Unfortunately, it will take seven full years from the date of that account becoming delinquent for that blemish to fall off of your credit report. For a single missed payment, that's pretty obnoxious. That's why many people recommend trying out a goodwill letter, asking your loan servicer to remove that blemish from your credit report in light of the rest of your credit history.

This gets a little more complex if your account falls delinquent for a longer period. Say you miss three payments in a row, putting your account 90 days delinquent. If you then bring the account up to current, paying off that debt, those blemishes will stay on your report.

When, though, do they fall off? "Luckily," it's the date when the account first fell delinquent. So, the date at which the first payment was labeled late, plus seven years, all of those late payments will fall off. That can be a (very) slight boon to your credit score, letting slightly more recent blemishes fall off along with older blemishes.

This only works if it's a single instance, however. If you miss three payments, bring your account up to current, then six months later, miss another payment, the seven-year erasure will only remove the original string of blemishes and not the more recent one.

What if you completely abandon the account and it goes to collections? When the seven-year mark of the original delinquency is reached, the entire account, along with any accounts it was sold to as collections, will be removed. This is beneficial in that a delinquent account is removed, but it's also detrimental in that an old credit account is removed from your history, collectively making the age of your credit history lower.

This is why, if an account falls to collections, many people will consider trying a "pay for delete." A pay for delete is a negotiation with a debt collector. In it, you offer to pay some portion of your debt in exchange for the debt collector removing the blemish from your credit report. The debt collector makes money because they likely bought your debt for pennies on the dollar, and it's no benefit to them to punish you after you pay them, so many will accept these terms rather than have to hound you for years until they can no longer pursue a debt.

"If your account has been current ever since, the status will change to show "never late" when the last series of late payments falls off, and the account will appear as positive. However, if the account was never brought current, then the entire account will be removed seven years from the original delinquency date." – Jennifer White, via Experian.

One thing to note is that this isn't all-or-nothing. A delinquency will fade in impact the older it is until it finally falls off your credit history. Thus, you generally don't see a massive improvement when a late payment falls off your report because the negative impact of it has gradually faded over the years up to that point.

Another important age-related factor for your credit history is how old the accounts you maintain are. Generally, the older an account is, the better, especially with lines of credit like credit cards. A credit card that is one year old won't be necessarily as representative of your credit performance as a credit card that is six years old, with a similarly positive history of on-time payments and low utilization.

Credit bureaus will generally consider the average age of your accounts rather than just the age of the oldest. This is why opening several lines of credit in a short time can be indicative of something negative and can impact your score.

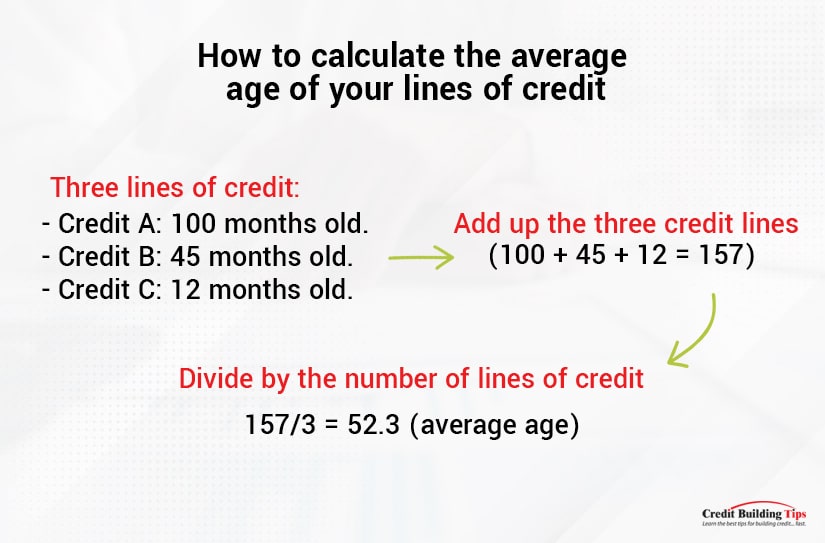

To calculate the average age of your lines of credit, simply take the average of each line's age. For example, if you have three lines of credit:

You add up the three (100 + 45 + 12 = 157) and divide by the number of lines of credit (three in this case, so 157/3 = 52.3, for an average of a little over 4 years old) to get your average age.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.

This is why it's generally recommended to keep an older line of credit around, even if you don't frequently use it. Setting it to auto-pay a few small bills and forgetting about it helps build credit passively, simply out of age and a history of on-time payments and low utilization.It's also important to keep your older lines of credit active. There are two reasons for this.

The first is that inactive accounts can, sometimes, be charged fees for being unused. This is relatively rare today, but some credit cards and other lines of credit, when left idle, might charge service fees or other charges just to be kept open. Luckily, this has been banned in the USA since 2009, so it shouldn't be a problem unless you're dealing with international creditors.

The second is that dormant accounts are often simply closed out by creditors. After a period of inactivity – usually at least a year, though it varies by creditor – they may simply close your account. In addition to losing any accrued rewards or benefits, you also lose that account's history on your credit report; rather than an old, active account, you have a closed account, which is worth significantly less.

Truthfully, this is one of the least important factors to concern yourself with when you're trying to improve your score.

Why?

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.

Well, it's simple: you can't speed up time. No matter what you do (short of traveling near the speed of light), you can't alter the flow of time. Your credit history's length will grow at a rate of one day per day, one year per year, and you can't really change that.The only thing you need to concern yourself with is keeping older accounts in good status and keeping lines of credit around as long as they benefit you. You may want to think twice about closing out an old credit card if it's acting as an anchor for the average age of your credit accounts, but that's not the credit history length metric at all. Remember, there are two different age-related metrics in your credit report.

Start building credit as early as you can, but otherwise, don't worry that much about it. If you're still young, just remember that you'll be building credit over time. If you're already older, chances are you've built up your history already, and the age factor is already as good as it can be.

If you ever have questions or concerns about anything credit related, please feel free to drop me a line at any time! I'd be more than happy to answer any of your potential questions and assist you on your credit building journey however I possibly can!

Your credit score is a rating of your financial reliability, and it's used by all sorts of different institutions to make decisions that affect your future and your lifestyle.

If you're trying to improve your credit score, you may have asked yourself, "Is there a limit to how good my credit score can be?" According to Experian, the short answer to this question is that while there are reports of individual credit scores as high as 990, the official highest possible credit score in the US is 850. But before we get into what exactly determines your FICO score and why it matters, let's take a step back and look at the big picture on credit scores in general.

It's a numerical score in a certain range, so the question is, is it possible to cap it? Can you hit the maximum possible credit score if you're very good at managing credit for years?

Let's dig in!

The FICO score is the credit score you're likely most familiar with. It's the one everyone thinks of when they think of credit score, even if they don't really know much about credit in the first place. FICO is the score tracked by the major credit bureaus, Experian, Equifax, and TransUnion.

There are, however, other credit scores and scoring systems, and a whole host of other credit bureaus, but we'll get to that in a bit.

The FICO score is the Fair Isaac Corporation's scoring system. Fair Isaac was formerly known as Fair, Isaac, and Company, founded by Bill Fair and Earl Isaac back in 1956.

Want a glimpse into Big Brother? The Fair Isaac Corporation is a data analytics company, and the FICO score was their hidden, secret way of rating and ranking people based on their financial history. The FICO score itself wasn't actually developed and made public until 1989, just 33 years ago.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.

Note: That's not to say that credit tracking is truly that new. The first credit reporting organizations sprang up in the late 1830s in response to the Panic of 1837, which started the Great Depression. It's just FICO in its current form that's only a few decades old.It shocks a lot of younger people to realize that the credit score system didn't exist before the 90s and that it's not really a thing outside of North America. Some other countries have credit scoring systems, but nothing quite the same as the U.S. model. Anyway, that's beside the point.

While FICO the company created and developed the analytics algorithms behind the FICO score, it's the job of the credit bureaus to aggregate the data and report on it accurately.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.

Another fun fact: while we think of credit as being managed by the big three credit bureaus – Experian, Equifax, and TransUnion – there are many more. It's just that those three are the national credit bureaus, while others are smaller companies with less range.Additionally, none of this is tracked by the government. Credit scores and credit reports are entirely managed by private companies, though the government has put regulations in place to ensure fair and accurate reporting, like the Fair Credit Reporting Act.

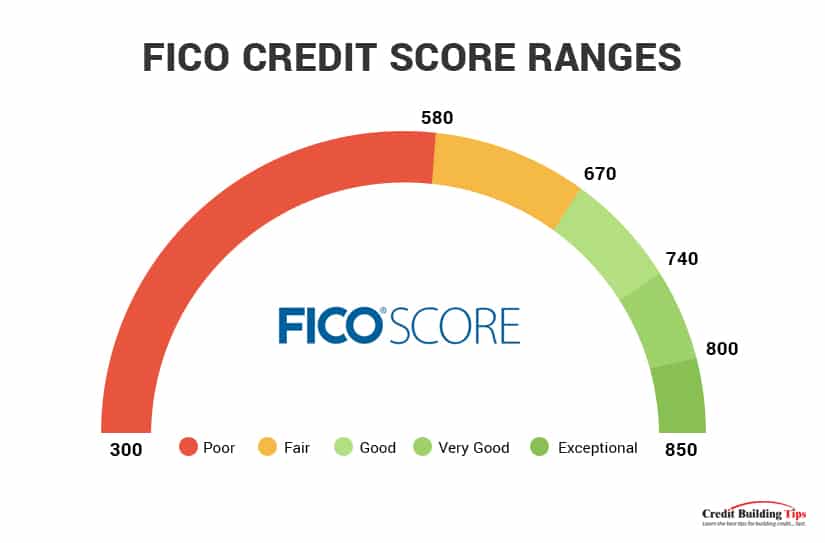

Back to FICO. The FICO score is the most widely-used score, and it is a numerical rating between 300 at the lowest and 850 at the highest. Therefore, for a FICO score, the highest possible score is 850.

Is it possible to get a perfect 850?

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.

The answer is yes. In fact, the FICO company itself says that around 1% of people have a perfect 850 score.There's no one sure-fire way to have a perfect credit score. It takes time, continued effort, smart decisions with your money, and a little luck. FICO itself says that the people with a perfect score share certain traits, such as:

So, if you're aiming for a perfect score, it's going to take quite a long time. Any late payments need to fall off your report, so it's at least seven years to wait. A long credit history is required, so virtually no one under the age of 38 (since 13 is the youngest you can be made an authorized user on a credit card and start your credit history.)

Luckily, a perfect score isn't necessary for anything but bragging rights. Anything over 720 or 750 is considered Excellent and will get you anything you need that checks credit.

Did you know that each credit bureau has its own way of calculating your score? Every breakdown of the FICO score out there is a generalization; each credit bureau uses its own proprietary algorithm. While similar, these are slightly different, so your score can vary between different bureaus.

The perfect score for these is still 850, but you might not be able to reach it on all the different credit bureaus at once. Equifax reporting 850 doesn't mean TransUnion also reports it. Again, though, anything over 720 is good enough.

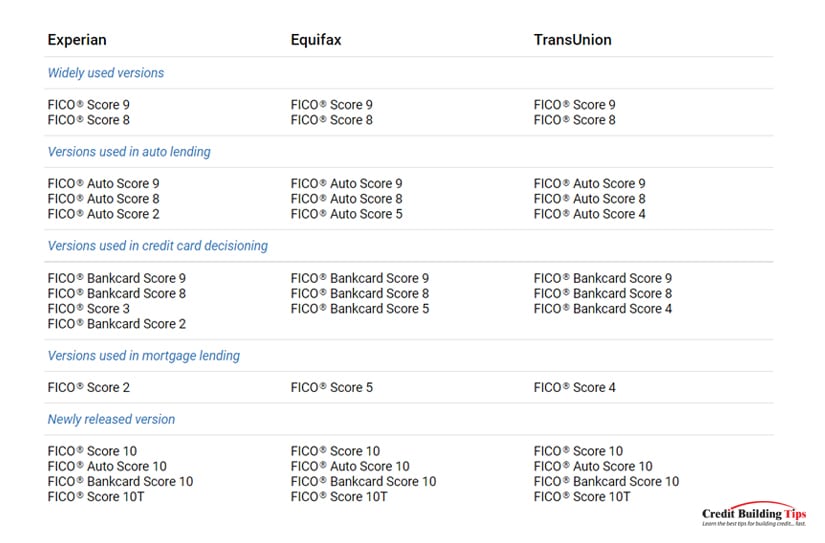

FICO also provides a range of other scores, mostly centered around specific industries. These scores are tailored to different banks and different purposes. There are 49 different scores provided by FICO and potentially hundreds more from other sources.

These are generally narrower, more tailored scores that focus on a specific kind of financial deal.

For example, there are:

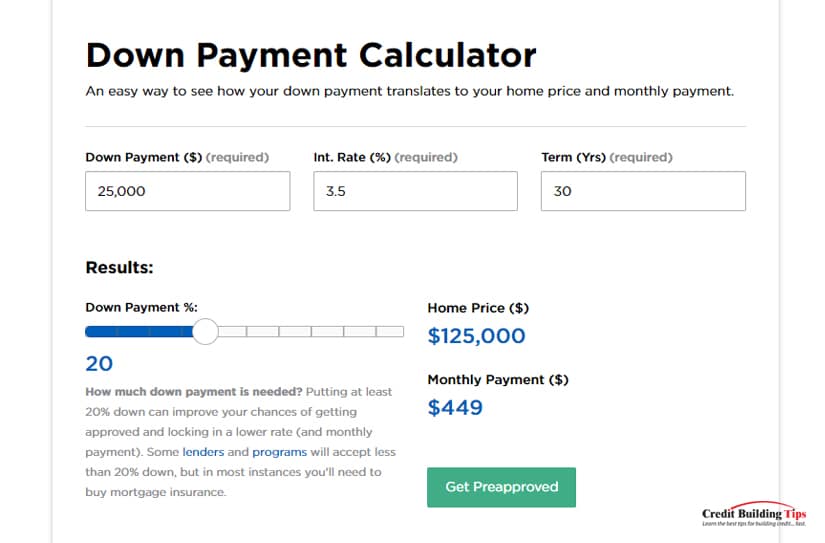

So, a mortgage lender might not be looking at your full FICO score; they'll be looking at a tailored score that focuses on key metrics that indicate suitability for a mortgage. You could have a perfect general FICO score, but your FICO Mortgage score could be lower.

We cannot reiterate enough, though, that the variance between them won't be so major as to be worth worrying over. Any score above 720 or so is good enough, regardless of your narrower goal.

FICO was created by the Fair Isaac Company and is reported by the credit bureaus. However, the credit bureaus also teamed up to create a competing score. After all, why should they do all the legwork for someone else's algorithm when they can use the same data to generate their own score instead?

Of course, FICO is so engrained in modern financial dealings that they can't just do away with it. So, now the bureaus offer both FICO and VantageScore.

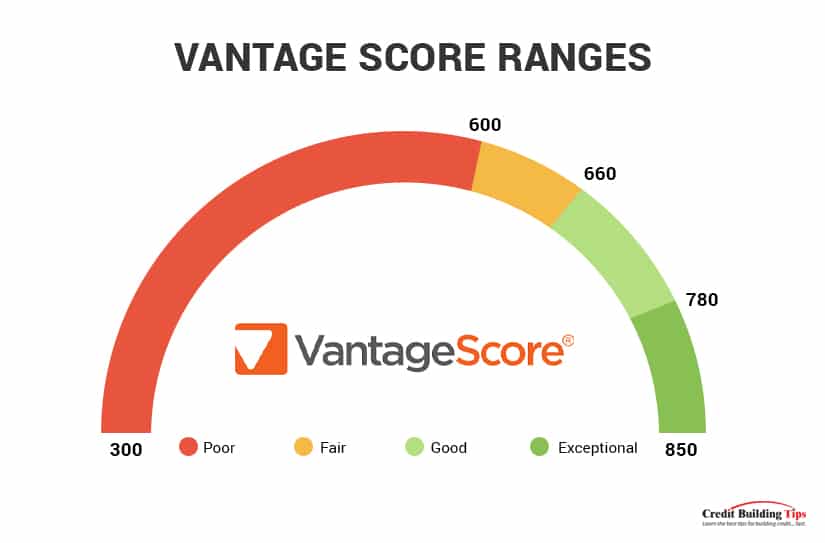

VantageScore is an alternative credit scoring system. When it was invented, it used a different numeric scale, ranging from 501 to 990. Since this disparity was confusing and unnecessary, however, the modern version of VantageScore (released in 2006) uses the same 300 to 850 system as FICO, so they're more directly comparable.

While both FICO and VantageScore monitor the same metrics, they weigh them differently. Thus, your two scores can be different, despite your financial situation remaining the same. The two scores are similar enough now that having anything over 750 on both of them is good enough.