The most current information on loans for veterans from the Department of Veterans Affairs (VA) says that VA direct and VA-backed Veterans home loans can "help Veterans, service members, and their survivors to buy, build, improve, or refinance a home."

As of 2023, loan limits are at an all-time high, which makes it possible for "service members to buy a home with no down payment." Veterans need to meet several requirements, but the loan program has several "perks" along with not needing a down payment.

According to benefits.va.gov, the main pillars of the VA home loan benefit include:

Two other benefits include:

They aim to provide:

"A home loan guarantee benefit and other house-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy."

While the VA Home Loans are given by private lenders, such as traditional banks and mortgage companies, VA stands behind a portion of the loan. This lets the lender offer you more favorable terms.

Let's discuss the VA loan process, as well as some special credit requirements that you must meet before you apply for them.

Let's discuss the VA loan process, as well as some special credit requirements that you must meet before you apply for them.The research team at Consumer Affairs "vetted 11 VA lenders rated by over 27,613 borrowers." Their top picks have at least a 3.5-star overall satisfaction rating as well as a 2:1 ratio of 5-star to 1-star reviews over the period of April 29, 2020, through April 29, 2021.

Here are their top findings:

Not surprisingly, Veterans United Home Loans was their top pick overall.

The company only offers VA loans and is intimately familiar with its programs. Reviewers had this to say about their experience with Veterans United Home Loans:

Currently, the US Department of Veteran Affairs doesn't set a minimum credit score. This good news may be somewhat misleading, however, as the private lenders who offer VA loans do set minimum credit scores to qualify for a loan.

While a conventional loan requires, as a minimum, a 620-credit score, loans backed by the VA typically require, as a minimum, a credit score of 580 to 620.

While a conventional loan requires, as a minimum, a 620-credit score, loans backed by the VA typically require, as a minimum, a credit score of 580 to 620.Not everyone is eligible for a VA loan. Consumer Affairs again distilled down Veterans United's critical requirements, as well as the requirements of which you may need to meet one or more.

Critical loan requirements:

Service loan requirements (one or more):

If you don't feel you meet these minimum service requirements, don't despair. The VA's criteria are nuanced, and talking with one of the company's loan specialists can help you determine whether or not you still qualify.

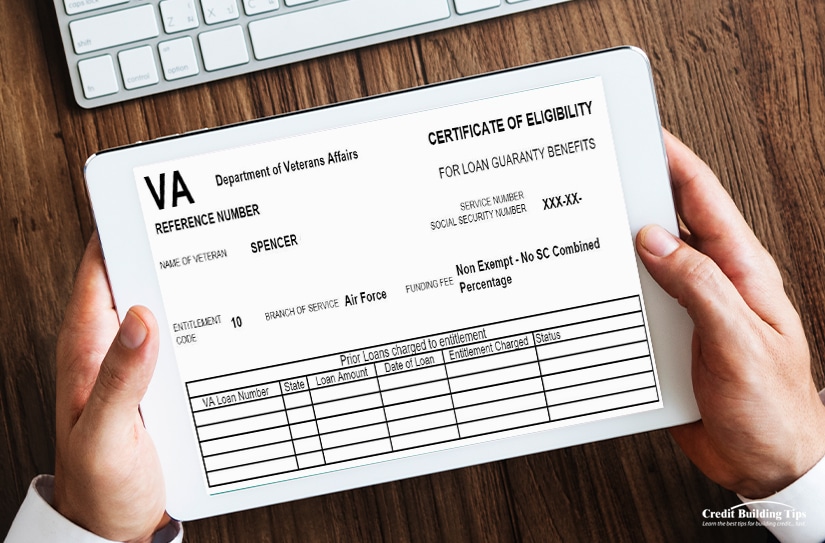

Before you can qualify for a VA loan, you'll need to apply for and receive a VA loan certificate. The certificate is issued by the US Department of Affairs and gives legal credence to:

You can request a COE online by logging in at the eBenefits with your Premium DS Login account. Once there, you'll need the following:

Any discharged members of the National Guard or Reserves who were never active need to meet a few other requirements. Check out the list.

Even if you were discharged with less than the minimum service requirements, you might still qualify for a COE if one of the following reasons apply:

You may not be eligible for VA benefits if you've received an "other than honorable, bad conduct, or dishonorable discharge, but there are still two ways you can try in order to qualify:

Besides an approved credit score and your COE, potential lenders will also look at how much credit you currently have, your debt-to-income ratio (DTI), your history of making timely payments, and your current income to determine whether you qualify and what interest rate you'll be offered.

The VA lists 41% as the maximum DTI ratio at which they'll approve loans. Exceptions may be made for applicants who have enough "residual" income even if their ratio is above the 41% preferred.

As mentioned before, most VA loans don't require a minimum down payment when it comes to making a down payment on a house purchase. But if the price of your new home is more than its appraised value, you may be required to pay some amount to make up a chunk of the difference.

Even if that's not the case, any amount you can put down as a down payment will help to minimize the VA funding fee. This is a one-time fee the VA requires veterans to pay on a VA-backed or VA direct home loan. The fee helps "lower the loan cost for US taxpayers.

The amount of the fee depends on how much you are borrowing as well as other factors. You can pay the fee by either including the fee in your loan and paying it off over time or paying the fee in its entirety at closing.

Even though the VA will approve those with lower credit scores, your credit score is still one of the most important factors lenders consider when evaluating your loan application. Your credit score reflects your past payment history and other information about you and your credit accounts, such as how much debt you have and how many accounts you've opened recently.

A good credit score indicates that you're a reliable borrower and can be trusted to repay loans on time.

The following factors can affect your credit score:

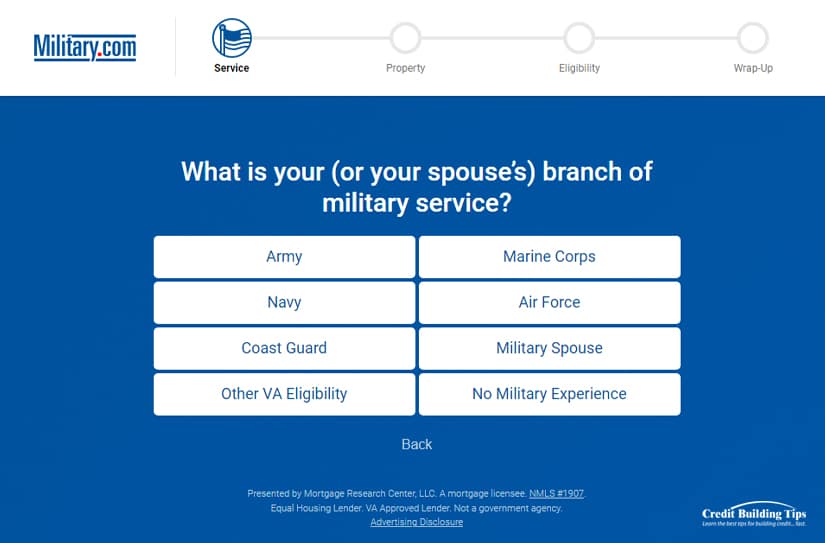

Military.com outlines the "six easy steps to a VA Loan" and offers "more information on the process," along with the chance to get several no-obligation quotes.

These six outlined steps are:

Although VA loans offer some of the best deals in the mortgage industry, there are still a few disadvantages to consider. For one, many lenders require a funding fee that can range from 1.4% to 3.6% of the loan amount. This can add up to a significant amount over time and reduce the overall savings from the loan.

Additionally, borrowers are limited to the types of properties they can buy with a VA loan; they are not allowed to purchase second homes, vacation homes, or investment properties. As well, VA loans may require an appraisal that can cost more than appraisals for conventional loans.

For over 20 years now, we, as Americans, have celebrated National Appreciation Month and publicly show our appreciation for the US Armed Forces. The president makes a proclamation and reminds us of the important role every soldier has played in the history and development of our country.

The VA has a network of eight Regional Loan Centers ready to offer consultations for those veterans who are struggling financially.

Currently, regional loan centers are closed to the public. However, you can reach a VA Home Loan Representative by calling toll-free, 1-877-827-3702, anytime Monday to Friday from 8:00 am to 6:00 pm EST.

Alternatively, if you'd like to reach out via mail, in person, or by email, you can find the contact information on each of their regional loan centers:

Operation Gratitude "proudly delivers Care Packages to deployed troops, first responders, military families, recruit graduates, veterans, wounded heroes, and caregivers." Its vision is for "all who serve [to] believe the American people care, and their mission is to "honor the service of our Military and first responders by creating opportunities to express gratitude."

One of the ways they do this is through their letter-writing program. We'd like to encourage you all to take a few minutes to recognize the services, sacrifices, and courage these men and women show every day.

If you ever have any questions or concerns about anything credit-related, we'd be more than happy to assist you. Drop us a comment down below, and we'll be sure to get back to you as soon as possible! Additionally, why not check out our other articles while you're here? We've written dozens of articles all about credit and credit-related topics, so it's very likely you'll find information useful to your particular situation.